South Sudan - Oil

South Sudanís economy is exceedingly oil-dependent. No other oil-exporting country is as highly dependent on this one commodity. As the country approached independence, 98 percent of Government of South Sudan revenues, and about 80 percent of gross domestic product, came from oil, as part of revenue sharing agreed to in the 2005 Comprehensive Peace Agreement (CPA) that ended the north-south civil war. This almost total reliance on a single revenue stream makes the country vulnerable to economic shock from fluctuations in the price of oil or any disruptions in production.

South Sudanís economy is exceedingly oil-dependent. No other oil-exporting country is as highly dependent on this one commodity. As the country approached independence, 98 percent of Government of South Sudan revenues, and about 80 percent of gross domestic product, came from oil, as part of revenue sharing agreed to in the 2005 Comprehensive Peace Agreement (CPA) that ended the north-south civil war. This almost total reliance on a single revenue stream makes the country vulnerable to economic shock from fluctuations in the price of oil or any disruptions in production.

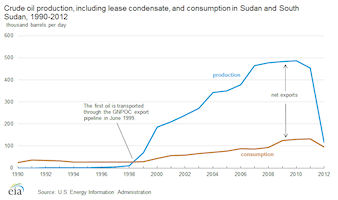

The unified Sudan has been producing oil since the 1990s. Most of the producing assets are near or extend across the de facto border between Sudan and South Sudan. When South Sudan became independent in July 2011, it gained control over most of the oil production. But South Sudan is landlocked and remains dependent on Sudan because it must use Sudan's export pipelines and processing facilities.

In January 2012, South Sudan voluntarily shut in all of its oil production because of a dispute with Sudan over oil transit fees. Following South Sudan's secession, Sudan requested transit fees of $32-36/barrel (bbl) in an attempt to make up for the oil revenue loss, while South Sudan offered a transit fee of less than $1/bbl. Tensions escalated at the end of 2011 when Sudan began to confiscate a portion of South Sudan's oil as a payment for unpaid transit fees, and shortly after, South Sudan shut down production. After nearly 15 months of intermittent negotiations, South Sudan restarted oil production in April 2013. Despite the progress that has been made to reconcile differences, several unresolved issues remain and production may be curtailed again in the future.

Oil plays a vital role in the economies of both countries. According to the International Monetary Fund (IMF), oil represented around 57 percent of Sudan's total government revenue and around 78 percent of export earnings in 2011, while it represented around 98 percent of total government revenues for South Sudan in 2011. The IMF projected that Sudan's oil earnings substantially declined following the South's secession. According to IMF estimates, oil accounted for 32 percent of total export earnings and 30 percent of Sudan's total government revenue in 2012.

The border separating Sudan and South Sudan is still not officially defined, and some areas remain contested. The current de facto border was established when Sudan gained independence in 1956; it is known as the 1956 border. The CPA called for the border to be demarcated, and a Technical Border Committee (TBC) was established in 2005 to demarcate the 1956 border. The committee agreed on most of the border, but five areas remain disputed, according to a report by the International Crisis Group.

The border separating Sudan and South Sudan is still not officially defined, and some areas remain contested. The current de facto border was established when Sudan gained independence in 1956; it is known as the 1956 border. The CPA called for the border to be demarcated, and a Technical Border Committee (TBC) was established in 2005 to demarcate the 1956 border. The committee agreed on most of the border, but five areas remain disputed, according to a report by the International Crisis Group.

One of the most contentious areas, which was excluded in the TBC's mandate, is the Abyei area, located between Northern Bahr al Ghazal, Warrap, and Unity states. Oil was discovered in Abyei in 1979, which escalated tensions between both sides. The Abyei Boundary Commission (ABC) was authorized to define the territory, and in 2005 it ruled that the Heglig and Bamboo oil fields fell within Abyei. The North contested the ruling because it placed a significant portion of its oil reserves in the disputed territory. The dispute was later sent to The Permanent Court of Arbitration (PCA) in The Hague. In 2009, PCA redefined the Abyei area and placed Heglig and the Bamboo fields outside of Abyei.

A referendum was scheduled for January 2011 to determine whether Abyei would join Sudan or South Sudan, but this did not occur because of disagreements over voter eligibility. Although uncertainties over border demarcation and the ownership of Abyei remain, the Heglig and Bamboo fields are considered today to be in Sudan's South Kordofan state.

South Sudan created the 2012 Petroleum Act, which outlines the institutional framework governing the hydrocarbon sector. The Act established the National Petroleum and Gas Corporation (NPGC). NPGC is the main policymaking and supervisory body in the upstream, midstream, and downstream segments of the hydrocarbon sector and is authorized to approve petroleum agreements on the government's behalf. The Ministry of Energy is responsible for the management of the petroleum sector.

China is the leading export destination for crude oil from Sudan and South Sudan. In 2011, Sudan's crude exports accounted for 5 percent of China's total crude oil imports, but in 2012 this share fell to less than 1 percent because of the production shutdown in South Sudan. International oil companies (IOCs), primarily from Asia, dominate the oil sectors in both countries. They are led by CNPC, India's Oil and Natural Gas Corporation (ONGC) and Malaysia's Petronas. These companies hold large stakes in the leading consortia operating in both countries: the Greater Nile Petroleum Operating Company, the Dar Petroleum Operating Company, and the Sudd Petroleum Operating Company.

China is the leading export destination for crude oil from Sudan and South Sudan. In 2011, Sudan's crude exports accounted for 5 percent of China's total crude oil imports, but in 2012 this share fell to less than 1 percent because of the production shutdown in South Sudan. International oil companies (IOCs), primarily from Asia, dominate the oil sectors in both countries. They are led by CNPC, India's Oil and Natural Gas Corporation (ONGC) and Malaysia's Petronas. These companies hold large stakes in the leading consortia operating in both countries: the Greater Nile Petroleum Operating Company, the Dar Petroleum Operating Company, and the Sudd Petroleum Operating Company.

On March 12, 2013, Sudan and South Sudan released an implementation matrix with a timeline to carry out the activities in the cooperation agreements. Most notably, the implementation matrix set dates to demilitarize the buffer zone along the shared border and to restart oil production. South Sudan resumed limited oil production on April 6, 2013. Initial production of 4,000 to 6,000 bbl/d came from the Thar Jath field in Block 5A. Production at South Sudan's largest fields in the Upper Nile State (Blocks 3 and 7) started about one month later.

Although production has finally resumed, it is still unclear whether there will be another prolonged shut-in in the near future. In May 2013, shortly after production resumed, South Sudan was forced to partially shut in production for a few days at Blocks 3 and 7 after Sudan turned off the pump station at the central processing facility in Jebelein, Sudan. Sudan claimed it turned off the pump station because of technical problems, but South Sudan believes the decision was politically motivated. The pump station was returned to operations, and the South was able to avoid significant economic and environmental costs that would have occurred if oil flows were disrupted for a longer period of time because of the lack of storage space near the fields.

The main issue that is fueling tension between the two countries is the support for rebel groups. Sudan presented South Sudan with a 60-day notice, starting on June 9, to cut off access to its two main export pipelines after accusing South Sudan of backing rebels that are trying to overtake Sudan's government in Khartoum, an allegation that South Sudan denies. Sudan had postponed the deadline to close the pipelines twice to allow the African Union more time to investigate the allegations and for further negotiations. In early September, Sudan reported that it would continue to allow South Sudan to export its oil through Sudan's pipelines.

South Sudan is considering the construction of an export crude oil pipeline that would allow the country to bypass the current route through Sudan. South Sudan has been discussing their options with authorities in Kenya, Ethiopia, and Djibouti to possibly build a pipeline either to the Kenyan Port of Lamu or to the Port of Djibouti via Ethiopia. South Sudan has signed a Memorandum of Understanding (MoU) with all three governments to build the pipelines. The latest news on the topic is that Japan's Toyota Tsusho Corporation completed a feasibility study to construct the pipeline to the Port of Lamu and may finance and build the pipeline.

An alternative pipeline route would reduce South Sudan's reliance on Sudan, but the pipeline's construction could take at least two years. In addition, there are no major oil fields scheduled to come online in South Sudan and production has been projected to decline substantially in the next five years, according to a Foreign Reports Bulletin released in March 2012.

|

NEWSLETTER

|

| Join the GlobalSecurity.org mailing list |

|

|

|