Message from the CFO

Last updated: 10/17/2023

We will maximize financial and non-financial corporate value through fundamental structural reforms and

new foundations for growth.

Ryosuke SakaueExecutive Corporate Officer, CFO (Chief Financial Officer)

Two years since the business integration

While we saw certain integration effects, the delay in PMI represented a significant challenge.

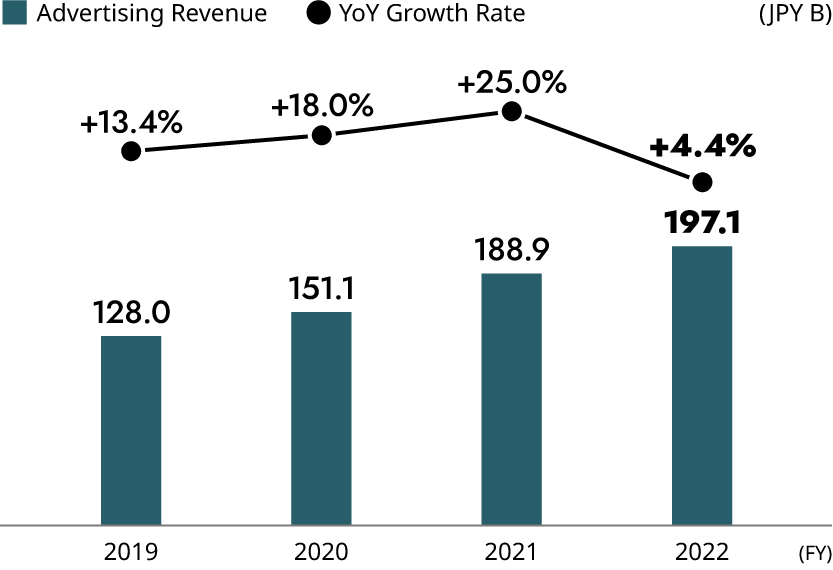

Two and a half years have passed since the business integration of LINE Corporation (“LINE”) and Z Holdings Corporation in March 2021. Notable achievements of the integration during this period is the 1.5-fold growth of the revenue of LINE’s core advertising business, from JPY128.0 billion in FY2019 before the integration to JPY197.1 billion in FY2022. LINE’s overseas business revenue also increased by 1.5 times, from JPY62.8 billion in FY2019 to JPY97.4 billion in FY2022. In terms of profitability, LINE overcame its structural deficit and became profitable after the integration. We managed to achieve the expected outcome in these areas.

Regrettably, however, we failed to achieve PMI as initially expected by our stakeholders over these two years. Profit growth ended weak compared to revenue growth as we were unable to streamline overlapping businesses and integrate businesses as planned due in part to the Group’s structure, where LINE and Yahoo Japan Corporation (“Yahoo Japan”) co-existed under the holding company, and the complex management structure, where a manager for each business domain existed in both LINE and Yahoo Japan. Our failure to create new businesses as well as unique businesses leveraging our strengths despite aspiring to become a “World-Leading AI Tech Company from Japan and Asia” was also one of our challenges.

In view of these results, we embarked on a merger of five Group companies in October 2023. By simplifying our management structure to a single CEO, one leader for each business, and seven directors from the previous ten, we will expedite decision-making and business operations and vigorously promote business integration and new business creation.

Revisions to medium-term targets

Targets were revised to be more precise, given the slowdown in the Internet advertising market.

This year, we revised part of our medium-term targets set at the time of the business integration with LINE in March 2021. Our FY2023 revenue target was revised downward from JPY2 trillion set in March 2021 to approx. JPY1.9 trillion and adjusted EBITDA*1 from a range of JPY390.0 billion to JPY356.0 to 366.0 billion. The revisions were based on the recognition that the Internet advertising market, which had sustained continuous growth, began to slowdown in the second half of FY2022, and that the situation will remain difficult for some time to come.

We also withdrew our target of becoming No.1 in domestic e-commerce transaction value by the mid-2020s, which we had upheld from before the business integration. Going forward, we intend to steadily grow our market share while being mindful of the balance between growth and profitability.

Medium-Term Targets - Review

Structural reforms

We will reform our business structure to become a more efficient organization and solidify the foundation for further growth.

In FY2023, we will conduct fundamental structural reforms and aim to reduce JPY30.0 billion in fixed costs*4. Over the past two years, we saw an increase in business costs, including hiring costs, due to the boom of the Internet industry. As the advertising market turned sluggish in late FY2022, this year is the right time to review the inflated costs. We intend to strengthen our earning power comprehensively through structural reforms and transform ourselves into a lean corporate structure.

The JPY30.0 billion reduction in fixed costs mainly involves outsourcing, sales promotion, advertising, and personnel costs. I believe that we can reduce outsourcing costs as planned unless significant environmental changes or problems arise. I also expect to see a gradual reduction in personnel costs, as we have been reducing the hiring of mid-career employees since October 2022.

The reduction of sales promotion and advertising costs is expected mainly in the Commerce Business. Our Group has worked to reinforce e-commerce since 2013. Through aggressive point rewards and the acquisition of fashion e-commerce company, ZOZO, Inc., we have increased our transaction value*5 by almost five times from approx. JPY350.0 billion in FY2013 to JPY1.7 trillion in FY2022. However, the shopping mall-type business with free tenant fees is not a highly profitable business. Looking ahead to the next ten years, we have decided that the shopping mall business should aim for more sustainable business growth, and have decided to review our conventional promotion measures centered on point reward campaigns.

Due to this policy shift, we expect significant reductions in sales promotion and advertising costs. Although we experienced a negative year-on-year growth in transaction value*5 for FY2022 Q4, the marginal profit ratio of Yahoo! JAPAN Shopping has improved significantly following the policy shift. Going forward, we intend to turn transaction value*5 from negative to positive growth by launching efficient promotions using Group assets such as LINE and PayPay.

In addition to cutting fixed costs, we will accelerate our initiative to selectively focus on key businesses in FY2023. We are reviewing all businesses, streamlining overlapping businesses, and reallocating personnel. We will consider all options, including withdrawal, for the businesses that cannot be expected to become profitable within FY2024. By selectively focusing on key businesses during FY2023, we expect to see a reduction in deficits in the order of JPY10.0 billion per year in and after FY2024.

Capital allocation

Cash flows of the financial business improved significantly due to the consolidation of PayPay.

From here on, I will give separate explanations on capital allocation for the financial and service businesses, since the approach to funding differs between these services.

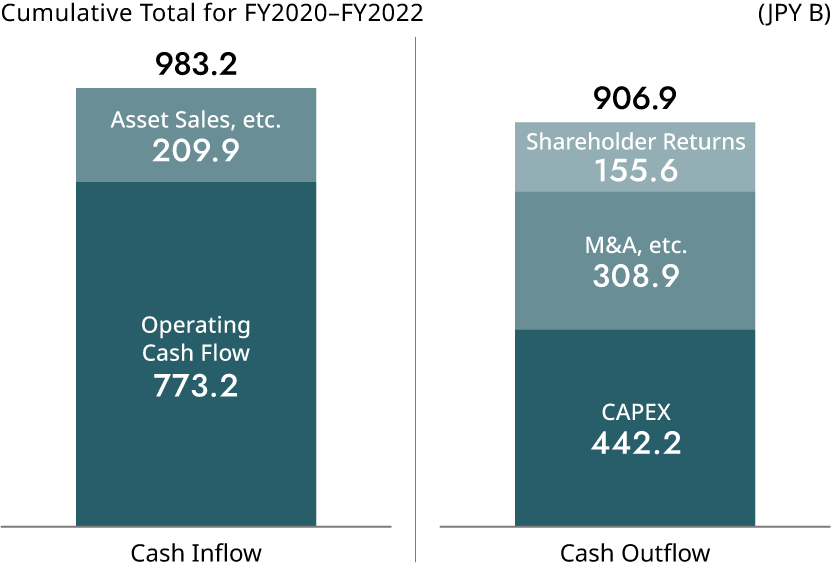

Cash inflows of the Internet business excluding the financial business*6 consist of operating cash flows, asset sale, and others. Cash outflows include capital expenditure for items such as data center servers, and a certain degree of new M&As (including capital increases to Group companies). The cash inflows minus these growth investments will be used for shareholder returns. If we have extra capacity on top of our policy of maintaining our current dividend level of JPY5.56 per share, we intend to flexibly implement share buybacks, balancing our financial situation and growth investments.

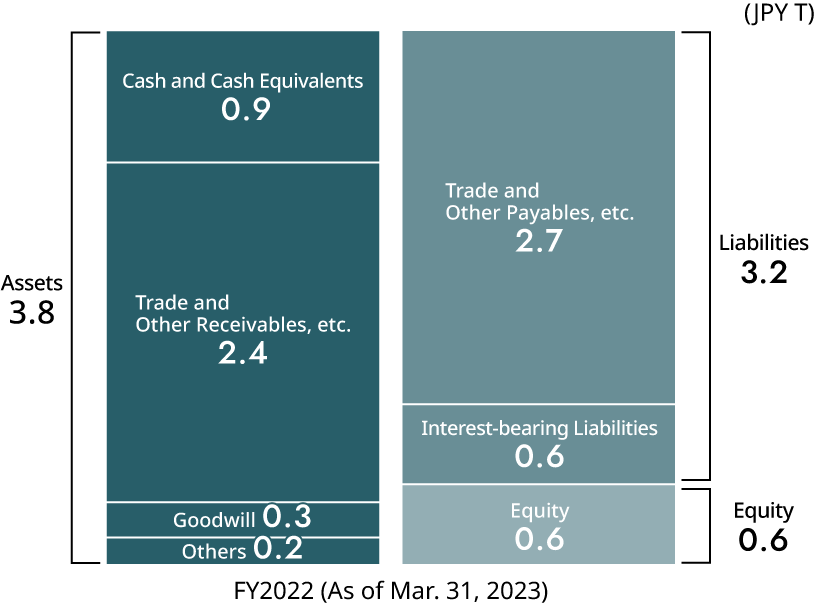

Meanwhile, based on the approach of operating financial business*6 with funds raised by the financial business, the capital allocation (including financing) for the financial business is managed separately from the Internet business. Until PayPay Corporation was consolidated in October 2022, there was a temporary increase in the need to raise funds partly due to the significant growth of the credit card business. However, free cash flows improved considerably and have been positive since FY2022 due to the increase in efforts to securitize receivables, a key financing source, and the consolidation of PayPay Corporation, which brought with it an advance cash inflow business model where most users top up their PayPay balance using their bank deposits or cash before payment.

Growth investment

We will make investments focusing on the acquisition of LYP Premium members and improving search functions.

Growth investments will primarily be made in the following two fields. First, to accelerate Group synergies, we have budgeted the costs for acquiring members of LYP Premium, which will be launched in November. As CFO, I will manage the execution of the budget based on an LTV (lifetime value) to CAC (customer acquisition cost) ratio of 4–10.

We also plan to make investments to improve our market share in the search business. Thirty years after the birth of the Internet, search still serves as the gateway to the Internet. Even if Internet advertising faces a challenging situation, there is still a strong demand for search ads. Going forward, search functions will also become critical in using generative AI. To increase our market share in search, we must enrich our search results and enable users to be exposed to the information they want on the first search result page. If we can achieve this, we will be able to have a robust competitiveness in our search and media businesses. Therefore, we intend to invest in data development to enrich search results. These are the two main growth investments for the time being. Basically, we plan to recover the investment within five years.

There are three policies for M&A: 1) The target company must be related to the media, e-commerce, or fintech domains; 2) The target company must be the No.1 company or one-of-a-kind in the domain and have established a unique position and competitiveness; and 3) The target company must be made a subsidiary as a rule. This is because a business or capital alliance will not enable us to have a sufficient grip on the business strategies of the target company, and synergy generations will be difficult. Furthermore, since generative AI may become a key technology in the future, we are considering investments in this field in all three domains.

From a financial point of view, we have set a benchmark of an IRR (internal rate of return) of more than 10%. Given that the capital market expects our business to grow at a high rate, a double-digit IRR above WACC should be required in M&As. As CFO, I am very aware of this benchmark.

Financial discipline

We will make flexible and effective investments within a net leverage ratio of 3x or less.

The financial discipline will also be explained individually for the Internet business excluding the financial business*6 and the financial business*6.

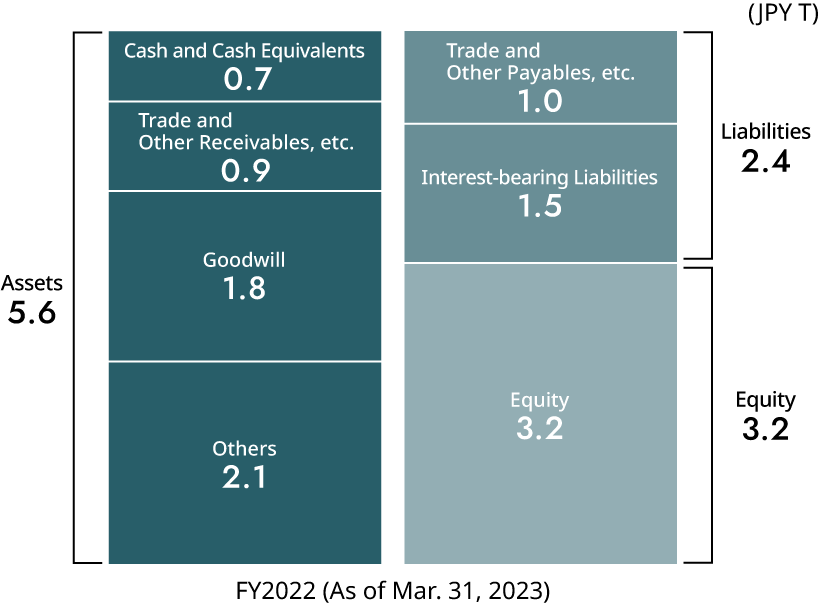

The Internet business excluding the financial business*6 may continue to utilize corporate bonds, bank loans, and other external funds to secure the funds for growth investments. However, there are no changes to our previous financial discipline policy of maintaining a net leverage ratio*8 of 3x or less to preserve our current financial rating.

In the financial business*6, on the other hand, securitization of accounts receivable in the credit card business reached approx. JPY373.0 billion at the end of March 2023. Since the credit card business has a longer cash conversion cycle than the Internet business (including advertising and e-commerce) and PayPay’s payment business, the securitization scheme has become one of the main financing instruments. We expect securitization to continue to increase in line with the expansion of credit card transaction volume at PayPay Card Corporation. Centered on this securitization scheme, we will work to diversify financing methods for the financial business*6 so that the financial business can finance itself. We will also keep an eye on the capital adequacy ratio for financial soundness. The ratio may deteriorate in the short term as business expands, but we will aim for 10% as an appropriate level in the medium to long term.

Capital efficiency

We will quickly restore EPS diluted by the integration through continuous profit growth and optimization of shareholders’ equity.

EPS (earnings per share) was diluted due to the business integration with LINE. The greatest challenge concerning capital efficiency is to restore this EPS to pre-integration levels as soon as possible. Although LINE’s profitability has improved since the integration, with established surpluses, this has not been enough to cover the number of shares, which increased by approx. 1.6 times due to the integration. In order to prove that the business integration will contribute to the medium- to long-term improvement in shareholder value, we must restore EPS to the pre-integration FY2019 level of JPY16.88 in the next few years.

To this end, we must first achieve our target of double-digit adjusted EBITDA*1 growth in FY2023, which we announced in April 2023, and continue to achieve profit growth. As I explained in our capital allocation policy, we also intend to carry out share buybacks and other measures to optimize shareholders’ equity at the appropriate timing using surplus funds if cash inflows exceed cash outflows after growth investments, M&As, and shareholder returns.

Shareholder returns

While maintaining stable dividends, we will accelerate growth by creating new services.

Our shareholder return policy is to maintain a stable dividend of JPY5.56 per share per year and return any surplus funds to shareholders through share buybacks and other means. However, I do not consider this to be enough. What our stakeholders expect the most from our Group is to continue creating competitive new services since this is the very source of our corporate value.

For this reason, it is of utmost importance to create new and valuable services in the areas of Internet media, e-commerce, and fintech that can only be created by our Group, and prove our sustainable growth in this industry. By doing so, we hope to achieve an appropriate share price and aim for a total shareholder return (TSR) that constantly exceeds 100%.

Sustainability initiatives

We will work to solve various social issues through our business and contribute to realizing a sustainable society.

For a company to achieve continuous growth, it must contribute to the realization of a sustainable society through ESG and other non-financial initiatives, in addition to aiming to fulfill its financial goals. That said, I believe it is more important to practice sustainability through business than engaging in special sustainability activities. For example, our Group provides Yahoo! JAPAN Disaster Alert as a solution that leads to the prevention and reduction of natural disasters, such as flood disasters due to typhoons and linear rainbands, which have recently become increasingly frequent in Japan. YAHUOKU!, Japan’s largest online auction service, contributes to waste reduction by promoting the reuse of various items.

In order to contribute to solving a broad range of social issues through its business activities, the LY Corporation Group has identified six materiality issues. Among them, we place particular importance on the first issue: “Providing new (WOW/!) experiences using data/AI.” Our Group has provided services that make people’s lives more convenient and comfortable, such as LINE, Yahoo! JAPAN, and PayPay. Going forward, we intend to continue providing new experiences that surprise and inspire people by combining AI to innovate our services.

While it is natural to consider profitability when creating these services, profit is not everything. For example, we believe that Yahoo! JAPAN Kids, a portal website for children, is of great social significance in that it provides safe and enjoyable content, such as dietary education, information search, illustrated encyclopedia, and games. We have provided these services for over a quarter of a century based on the decision that these services should be continued in the future as our Group’s DNA. To promote sustainability through business, it is necessary to make holistic decisions by considering both financial and non-financial aspects. This is why I, as CFO, am also responsible for ESG promotion.

Another important materiality issue is “operating safe & secure digital platforms.” Since our services are used by a cumulative total of 300 million people every day, building and maintaining thorough network security and data protection is a critical social responsibility as a platform operator. This point was made even more thorough after the business integration with LINE and must be reinforced continuously.

The materiality issue we position as a significant issue for the future is “reinforcing human capital.” For example, our Group has been working on AI-related reskilling since April 2023 as generative AI rapidly permeates society. Of course, we plan to continue focusing on talent development and reskilling while keeping an eye on technological innovations and changes in the business environment. Although we have made efforts to create an employee-friendly environment, there remain challenges in diversity. While many global talents have joined our workforce due to the integration with LINE, we still have some way to go in terms of empowering women in Japan. These are issues that we, the management, must be resolute in taking effective measures.

The newly created LY Corporation will pursue continuous business growth by implementing fundamental structural reforms to improve profitability as soon as possible and accelerating the creation of Group synergies through growth investments with an emphasis on financial discipline. We will also aim to maximize corporate value from both financial and non-financial aspects by creating new, valuable services and businesses unique to our Group. We thank our stakeholders for their continued support.

- *1 Adjusted EBITDA: Operating income + Depreciation & amortization ± EBITDA adjustment items

Depreciation & amortization: Depreciation, depreciation of right-of-use assets, certain rents

EBITDA adjustment items: Gains/losses on non-recurring and non-cash transactions within operating revenue and expenses (loss on retirement of fixed assets, impairment losses, stock compensation expenses, gains/losses on step acquisition, other transactions with undetermined cash outflows (one-time provisions, etc.), etc.)

Also, gains/losses on sales of shares held by certain funds.

Changed the definitions from FY2022. Added certain rents to depreciation and amortization, and gains/losses on sales of shares held by certain funds to EBITDA adjustment items. - *2 Announced in April 2018

- *3 Decided in February 2023

- *4 Excluding ZOZO, Inc., ASKUL Corporation, ValueCommerce Co., Ltd., and PayPay Corporation (consolidated).

- *5 Shopping business transaction value

- *6 The financial business includes PayPay Corporation, PayPay Card Corporation, the financial subsidiaries of Z Financial Corporation, such as PayPay Bank Corporation, and financial subsidiaries of LINE Financial Plus Corporation.

- *7 Credit card receivables securitization has been transferred from financial cash flows to operating cash flows.

- *8 Net leverage ratio=Net interest-bearing debt/Adjusted EBITDA (Figures for the last 12 months used for calculating adjusted EBITDA). Net interest-bearing debt=Interest bearing debt – Cash and cash equivalents.

- *9 The figures are rounded down to the nearest 10 billion yen and then rounded to the nearest trillion yen.