Posted

by Big Gav

in

coal to liquids,

ctl,

gas to liquids,

gtl,

ordos

Stuart Staniford at Early Warning has a post on the state of play for gas-to-liquids projects around the world - Gas-to-Liquids Production Statistics.

Continuing this little series on production stats for various forms of alternative liquid fuels, this morning I look at Gas-to-Liquids (GTL). This is a process in which:

Gas to liquids is a refinery process to convert natural gas or other gaseous hydrocarbons into longer-chain hydrocarbons such as gasoline or diesel fuel. Methane-rich gases are converted into liquid fuels either via direct conversion or via syngas as an intermediate, for example using the Fischer Tropsch process.

After researching it, there seems little hope of obtaining actual production statistics for this process globally, but we can get pretty close just from research on plant capacity and opening dates. The graph above summarizes the situation. There are three plants globally operating GTL processes at commercial scale, and together they sum to less than 100,000 barrels/day.

The longest standing plant is at Mossel Bay in South Africa, operated by PetroSA since 1987 (I assume this is another legacy of apartheid sanctions) which has a 36kbd output capacity.

In 1993, Shell began operating a small plant in Bintalu, Malaysia, and increased its capacity in 2005 (from 12.5kbd to 14.6kbd).

Most recently, Sasol and Qatar Petroleum brought on stream the Oryx plant in Qatar. This had a difficult start up, but is now apparently operating at the designed 34kbd capacity.

There are also other plants under construction: the 120kbd Pearl GTL plant in Qatar, and the Escravos plant in Nigeria. Both hope for production in 2010, but given the history of difficulties with GTL plant startup we should probably reserve judgement.

There were many more plans for GTL plants around the year 2000, but most went under. A helpful National Petroleum Council study report explains ...

Start also has a post on

coal to liquids -

Coal-to-Liquids Production Statistics.

So, in today's adventure in much-harder-to-find-than-they-should-be energy statistics, I try to assemble some kind of series for global production of synfuel from coal-to-liquids (CTL). This went even worse than the tar sands. However, I think I have figured out the big picture, and I report my findings here for the benefit of future energy sleuths, or in the hope that someone will point me at better data if it exists.

Firstly, for the sake of readers just getting up to speed, what we are talking about is the possibility to use various kinds of chemical transformations to make a petroleum-like liquid fuel from coal. See the Wiki entry on coal liquefaction for more details of the various possibilities. This was done most famously by the Germans during World War II, and has been done for a long time in South Africa; the South Africans needed to get around economic sanctions during the Apartheid era, and that country has a lot of coal and not much oil. Since there are huge amounts of coal underground around the world, CTL is often cited as a potential substitute for oil in future (generally by folks not worried about climate change).

There are at present two plants in the world operating coal liquefaction processes at commercial scale. The first is operated by Sasol in South Africa and has been operating for a long time. The second has just been opened last year by Shenhua in China. ...

Overall, the picture seems to be that South African production of CTL synfuel has been roughly flat for many years. There are some fluctuations, but there is certainly not an overall upward trend.

The data situation for the new plant in China is even sketchier. According to this page, the capacity of the plant is 1 million tonnes per year, which is about 1/7 of the output of Sasol in South Africa. It reached full production some time in mid 2009, so there would not have been a full year of production in 2009. Thus, at this time this represents a rather small increase in total global production of coal to liquids - perhaps of the order of 5-10%, with a little more coming in 2010 with, I assume, a full year of operation. Shenhua does have plans to increase the plant capacity to 3Mt in the future, which would give another increase when that occurs.

Amusingly, the CTL plant is located in a place we have already referenced on this blog: Ordos.

Posted

by Big Gav

in

air force,

air transport,

coal to liquids,

ctl

Technology Review has an article on a new coal to liquids process which could "allow Air Force jets to run exclusively on domestically produced biomass and coal" - Cleaner Jet Fuel from Coal.

The Air Force is testing a jet fuel made from coal and plant biomass that could replace petroleum-based fuel and emit less carbon-dioxide compared to using conventional jet fuels. The fuel is made with a process developed by Accelergy, based in Houston, using technology licensed from ExxonMobil Research and Engineering Company and the Energy and Environmental Research Center at the University of North Dakota.

Other recently tested experimental biofuels for jets have required that the aircraft still use at least 50 percent petroleum-based product to meet performance requirements, particularly for the most advanced military jets. But the Accelergy process produces fuels that closely resemble petroleum-based fuels, making it possible to do away with petroleum altogether. Because of this, the new process could help the Air Force meet its goal of using domestic, lower-carbon fuels for half of its fuel needs by 2016. Although the first products will be jet fuels, the process can also be adapted to produce gasoline and diesel.

The fuel has passed through an initial round of testing, including lab-scale engine tests, and is on track to be flight-tested in 18 months, says Rocco Fiato, vice president of business development at Accelergy.

Turning coal into liquid fuels is nothing new, but such processes have been inefficient and produced large amounts of CO2 emissions. Accelergy's approach is different because it uses "direct liquefaction," which is similar to the process used to refine petroleum. It involves treating the coal with hydrogen in the presence of a catalyst. Conventional technology for converting coal to liquid fuels breaks the coal down into synthesis gas, which is mostly carbon monoxide with a little bit of hydrogen; the hydrogen and carbon are then recombined to produce liquid hydrocarbons, a process that releases carbon dioxide. Because the Accelergy process skips the need to gasify all of the coal--which consumes a lot of energy--before recombining the hydrogen and carbon, it's more efficient and produces less carbon dioxide. "We don't destroy the molecule in coal. Instead we massage it, inject hydrogen into it, and rearrange it to form the desired hydrocarbons," says Timothy Vail, Accelergy's president and CEO.

Posted

by Big Gav

in

canada,

clean coal,

ctl,

ucg,

uk

It looks like UCG schemes aren't just confined to Australia - Technology review has an article on a venture in Canada - Getting Power From Coal Without Digging It Up.

Converting coal in the ground directly into clean-burning gases could have huge environmental benefits--not the least of which would be the avoidance of destructive mining operations. The problem is, technology for underground coal gasification is still in its early stages.

Now the government of Alberta says it will give C$285 million ($271 million) to a coal gasification project by Calgary-based Swan Hills Synfuels that involves the deepest-ever operation to generate power from coal--without digging it up.

Previous demonstrations of the technology have turned coal seams as deep as 1,000 meters below the surface into clean-burning gas. In contrast, Swan Hills Synfuels' C$1.5 billion project proposes to reach down 1,400 meters. Working at that depth could lessen the threat of groundwater contamination from the smoldering decomposing coal. "We've got 800 meters of rock--a lot of it impermeable--between us and freshwater aquifers," says Swan Hills president Doug Shaigec.

What's more, if the technology can get at deeper layers of coal, it could allow access to much more of the fossil fuel, says Julio Friedmann, who is carbon management project leader for Lawrence Livermore National Laboratory in California.

When the project starts up in 2015, Swan Hills hopes to generate 300 megawatts of power from its coal gas while selling over 1.3 million tons of carbon dioxide per year. The CO2 could be used by oil producers and ultimately stored in oil wells. This could result in the storage of 10 to 20 million tons of carbon dioxide per year by 2020. That would help Alberta meet its 2020 goal for carbon capture of 25 to30 million tons per year, according to a report last month from an alliance of Canadian industrial firms.

The British are also looking to ramp up their carbon dioxide emissions, in their case looking to coal reserves under the North Sea -

North Sea coal to be burnt underground.

Vast coal deposits lying deep beneath the North Sea will be burnt in situ to generate up to 5 per cent of Britain’s energy needs, under new plans approved by the Government last week.

The UK Coal Authority has awarded licences to Clean Coal, an Anglo-American company, to develop five offshore sites for a technology called Underground Coal Gasification (UGC).

The method, which has not been used on a commercial scale in the UK, although it is widely used in Australia [BG: this is a gross exaggeration], taps the high energy content of coal while doing away with the costly and labour-intensive need to mine it first.

Rohan Courtney, a former director of Tullow Oil who is chairman of Clean Coal, said that the potential for the technology was enormous. “There are enormous amounts of coal lying beneath the North Sea which have never been accessed,” he said. “This technology is going to open up the industry again in the UK.”

The sites approved for use stretch up to 10km offshore from Sunderland, Grimsby and Cromer on the shores of the North Sea, Canonbie, near Annan in Dumfries and Galloway on the other side of Scotland, and Swansea Bay, outside the entrance to the Bristol Channel. The combined coal reserves are estimated to be at least one billion tonnes, equivalent to more than one sixth of all the coal consumed in an average year around the world. Global consumption of coal is about 5.8 billion tonnes a year. Total consumption in the UK is about 80 million tonnes a year.

Posted

by Big Gav

in

coal to liquids,

ctl,

gtl,

linc energy,

ucg

Energy Minister Martin Ferguson reports that Linc Energy's coal to liquids (or more accurately UCG - underground coal gasification - then GTL - gas to liquids) demonstration plant has opened in Queensland - Coal-to-liquids demonstration plant opens.

The Minister for Resources and Energy, Martin Ferguson AM MP, has launched the world's first coal-to-liquids demonstration plant to use Underground Coal Gasification (UCG) technology.

Linc Energy's demonstration plant near Chinchilla in Queensland is producing clean synthetic diesel and jet fuel from gas sourced from deep underground coal reserves. First production was achieved on 14 October 2008.|

Minister Ferguson said: " Australia is coal and gas rich, with hundreds of years of reserves. Technologies that convert coal and gas to ultra-clean diesel and jet fuel have the potential to replace Australia's declining oil reserves and make us self-sufficient in liquid transport fuels once again.

"A domestic synthetic fuels industry would reduce - and maybe even one day remove - our growing trade deficit in petroleum products which last year grew to almost $15 billion."

Minister Ferguson said: "This technology unlocks energy from Australia's significant stranded and uneconomic coal reserves and has the potential to dramatically reduce Australia's dependence upon imported oil and refined products." ...

Minister Ferguson said: " Australia has enormous potential as a coal-to-liquids producer and an economically viable and environmentally sustainable coal-to-liquids industry would not only increase Australia's energy security, but also provide jobs, exports, revenue and economic growth, particularly in regional communities.

"Similarly, gas-to-liquids could open up new opportunities for development of Australia's vast northwest gas resources and east coast coal seam methane resources, complementing the potential of Australia's well-established LNG industry."

Posted

by Big Gav

in

coal to liquids,

ctl

This is an oldish story but I'll note it for completeness - McClathcy has a report that the US air force has dropped its plans to produce aviation fuel via a coal to liquids plant in Montana (noted by Cretaceous at TOD ANZ) - Air Force drops plan to make fuel from coal in Montana.

The Air Force on Thursday dropped plans to build a coal-to-liquid plant to produce fuel for its aircraft, a plan that would've reduced dependence on oil but increased the emissions of the heat-trapping gases that cause global warming.

The Air Force has a goal to certify that all aircraft could fly on a 50-50 blend of fuel by 2011. It's been purchasing fuel made from coal from Sasol of South Africa, most recently 300,000 gallons, said Air Force spokesman Gary Strasburg.

The B1, B52 and C-17 already have been certified to run on the coal-mix blend, and the F-15, F-22, C-5 and KC-135 all have also used the blend, Strasburg said.

The Air Force is looking for alternatives to oil to make sure that it can continue to operate its aircraft when supplies are tight. The coal-to-liquid conversion process, however, is expensive to set up and there are no full-scale plants in the U.S.

Liquid fuel from coal produces more than twice the greenhouse gas emissions as conventional petroleum-based fuel.

The Air Force for the past year had been considering building the plant at Malmstrom Air Force Base in Montana, one of three U.S. Air Force bases that maintain and operate the Minuteman III intercontinental ballistic missile.

The service had required that the coal-to-liquid plant would be privately funded, according to an Air Force news release on Thursday.

The Air Force rejected the plans for the coal-to-liquids plant because of possible conflicts with the 341 Missile Wing's nuclear mission. The release said the concerns included decreased security near the base's weapons storage area, interference with missile transportation and "explosive safety arcs and operational flight safety issues."

Posted

by Big Gav

in

australia,

bp,

coal to liquids,

ctl,

linc energy,

ucg

Bloomberg reports that Linc Energy is trying to fuel from its planned coal-to-liquids plant in South Australia to BP - Linc Extends Diesel Option With BP From Australian GTL Plant.

Linc Energy Ltd., an Australian energy company planning to convert coal into diesel, extended an option to sell fuel to BP Plc from its planned gas-to-liquids plant in southern Australia. ... The company plans to develop the so-called gas-to-liquids, or GTL, project in the Arckaringa Basin in southern Australia. The company acquired rights to explore the region, which may yield coal-seam gas, in June when it agreed to buy Sapex Ltd.

Posted

by Big Gav

in

coal to liquids,

ctl,

monash,

shell

The Business Spectator reports that Shall and Anglo-American have put the proposed Monash coal to liquids project on hold - yet another casualty of falling oil prices (though perhaps not one that will be missed much by those of us concerned about global warming and other environmental issues) - Shell, Anglo American rethink local coal-to-liquids project. More at Bloomberg amd The Australian.

Royal Dutch Shell Plc and Anglo American Plc are rethinking development of an Australian project to turn coal into liquid fuel, saying it might cost too much.

"Monash Energy, and its owners Shell and Anglo American, believe that, in the long term, coal to liquids may provide an opportunity for Victoria to provide domestically produced clean liquid fuels for Australian and international markets," Roger Bounds, project director at the jointly-owned Monash Energy Holdings Ltd venture, said in an e-mailed statement.

But Mr Bounds said critical requirements for the project were not yet in place for the oil and mining consortium to proceed to the next phase. "The reasons for this include higher capital cost estimates and escalated construction costs," Mr Bounds said.

Backers of many alternative energy projects around the world have delayed or scrapped plans since crude oil prices. Almost $A20 million ($US13 million) has been spent since September 2006 proving up the coal-to-liquids concept, according to Monash's website. Media reports estimate the project was originally estimated to cost $A5 billion to get up and running.

The core of the project is a large scale commercial plant in Victoria's Latrobe Valley drawing coal from its own mine and then drying and gasifying the coal for conversion into transport fuels. The use of brown coal for power generation in the Latrobe Valley accounts for 55 per cent of CO2 emissions in Victoria, a state with a population of around five million.

Another Australian venture between an oil company and a mining firm aimed at reducing Australia's greenhouse gas emissions has already been axed. BP Plc and Rio Tinto Ltd/Plc last May cancelled a plan to build a carbon capture power plant.

Posted

by Big Gav

in

coal seam gas,

coal to liquids,

csm,

ctl,

linc energy,

ucg

The Courier Mail reports that Queensland's coal seam gas producers have succeeded in chasing underground coal gasification hopeful Linc Energy out of the state, with Linc deciding its coal to liquids technology might find the going easier in South Australia - Linc pulls out of Queensland $1b liquids plan, heads to SA. More at Bloomberg.

UNDERGROUND coal gasification hopeful Linc Energy has seen the writing on the wall in Queensland and will transfer plans for its $1 billion gas-to-liquids plant to South Australia.

For many years Linc has been planning a large UCG-GTL plant at Chinchilla in Queensland, where it has spent close to $50 million on a pilot liquids plant and a coal exploration program.

It was hoping to begin detailed designs next year on a commercial facility, eventually producing 20,000 barrels of diesel and aviation fuel a day just down the road from the pilot plant.

But Linc, which recently took over Adelaide-based energy hopeful Sapex to get access to its large coal exploration areas in SA's Arckaringa Basin, yesterday announced that instead it would "focus on developing its first commercial UCG-GTL operation in South Australia".

The announcement came a day after BG Group, which has just taken over coal seam gas group Queensland Gas Company, called on the Queensland Government to give coal seam gas companies, rather than UCG groups, priority over coal exploration areas in Queensland.

At present, coal exploration licences (used by UCG groups) and petroleum licences (which govern CSG development) can exist over the same resource.

BG chief executive Frank Chapman said his group's plans to spend as much as $15 billion on CSG development and LNG processing at Gladstone -- where Santos, Origin Energy and Arrow Energy and their international partners are also planning large multibillion-dollar LNG developments -- would have to be delayed unless BG could get guaranteed resource security.

Linc, QGC and Arrow Energy, have competing petroleum interests over part of the coal areas Linc holds near Chinchilla.

There was no news from the Queensland Government yesterday on BG's demands. A spokeswoman for Mines and Energy Minister Geoff Wilson said there had been no formal or informal contact recently with Linc about its UCG plans.

But CSG groups have lobbied the Government hard, raising questions about UCG's commercial credentials and its safety, particularly as it relates to potential water table pollution, with rural interests also chipping in on the latter question.

And in an August statement the department had no intention of granting production tenures for underground coal gasification for at least three years.

Meanwhile the SMH has an update on the CSG boom, predicting rising gas prices for the NSW market -

It's boom time for Queensland coal-seam gas.

THE boom in eastern Australia's coal-seam gas industry will accelerate a rise in NSW gas prices, the national energy regulator says.

The State of the Energy Market 2008 report, to be published today, says the rush of projects to develop Queensland's coal-seam gas into an exportable liquidate form has already nudged up prices along the east coast, as producers seek higher returns.

A gigajoule of gas fetched $2.50-$2.90 two years ago but the report's lead essay by forecasters ACIL Tasman said recent sales in Queensland had peaked at $7.

Unlike electricity, gas markets outside of Victoria's are opaque and allow deals to be settled privately, leaving forecasts hazy. But the report said gas was regularly selling for above $4 a gigajoule, as producers seek "significantly higher prices".

Global oil powers have been attracted to converting Queensland's extensive reserves into liquefied natural gas (LNG), which can fetch much higher prices on global markets. No LNG plants have been suggested for NSW but prices are being forced up regardless.

Oil has fallen more than 60 per cent from its peak but the companies behind the multibillion-dollar LNG projects are confident of getting high prices despite the downturn.

"The fact that most of the major [coal-seam gas] producers are currently looking to boost reserves and production capacity to underpin proposed LNG facilities means that the supply surplus which had prevailed in the Queensland market for several years has now been reversed," it said.

Historically, Australians have had the world's cheapest gas. In the US, it costs about $US6.70 per million British thermal units, slightly less than a gigajoule. ...

Gas companies have long argued that prices are set to rise towards "export parity'. The report confirms the Queensland LNG plans are accelerating the process. Australia is the fifth largest LNG exporter. The coal-seam gas bonanza has seen the likes of ConocoPhillips in the US, Britain's BG Group and Malaysia's Petronas pay well above previous prices.

Posted

by Big Gav

in

australia,

carbon energy,

coal to liquids,

ctl,

queensland,

ucg

Mining Era has a post on another UCG hopeful in Queensland - Carbon Energy Plans To Set The World On Fire.

Underground conversion of coal to gas, in a safe and profitable way, has been one of the mining world’s “Holy Grail” pursuits for the past 70 years, without much success. In the next few weeks the latest attempt to prove the commercial viability of underground coal gasification (UCG) will reach a critical point as a small Australian company, with impeccable connections, “fires” its first substantial trial. In theory, Carbon Energy will burn a deeply-buried coal seam to liberate a range of gases at its Bloodwood Creek test site in Queensland, some gas will be suitable for power generation and some suitable as a feedstock for ammonia production. If successful, investors in the company will be delighted, especially the two biggest shareholders, the Australian Government’s science agency and the country’s biggest fertiliser producer, Incitec Pivot.

It’s the presence of the Commonwealth Scientific and Industrial Research Organisation (CSRIO) with its 18.6 per cent stake in Carbon Energy, and Incitec with its 11.2 per cent, which adds credibility to a process which has its fair share of doubters, and sets the company apart from two other UCG experiments in Australia. Common objections to UCG includes fears of groundwater contamination from burning coal underground, high levels of carbon dioxide being released and the conventional concerns about risks associated with all forms of new technology.

Carbon Energy, chief executive, Andrew Dash, dismisses those concerns as inaccurate and misinformed. He told an investment conference in Queensland last week that rising energy prices and environmental concerns created a perfect climate for UCG. “Our aim is to produce clean energy and chemical feedstock from UCG syngas (synthetic gas).” he said. “We are able to extract the energy in coal without the environmental effects associated with coal mining.” He told the conference that the technology had been developed by the CSIRO, and acquired from the science agency, which emerged from the deal as the biggest single shareholder in Carbon Energy.

Dash used a graph to claim that the energy extraction from UCG is close to double that from actually mining the coal and more than 10 times the energy from coal-seam gas with the added energy coming from the way UCG used the methane, hydrogen and carbon monoxide in the coal rather than the coal itself, or the coal-seam gas on its own. “What we’re doing is based on 10 years of research,” Dash said. “That has enabled us to choose the perfect site for our first major trial.”

Bloodwood Creek is located approximately 150 kilometres west of Brisbane in the coal-rich Surat Basin. Costing around A$20 million the project consists of drilling a series of boreholes down to coal seams 200 metres beneath the surface. The holes start vertically and then run horizontally along the coal seam. Going down one borehole is a mix of oxygen and steam. This is ignited at one end of the coal panel and allowed to burn in a controlled manner, giving off hydrogen, carbon monoxide, methane and carbon dioxide, which are returned to the surface for collection and separation. Incitec Pivot is keen to get its hands on some of the gases to make ammonia which will be used to make fertiliser and explosives for the coal-mining industry. Nearby power plants are interested in the methane to generate electricity and a speciality chemical firm, LyondellBasell Industries is interested in building a methanol plant using UCG products.

Investors have remained strong supporters of Carbon Energy in a tricky market. The company, which is the reincarnated shell of a once well-known gold explorer, Metex, snatched its first UCG headline on April 8 when (as Metex) it reported receipt of Queensland Government approvals to conduct the 100-day Bloodwood Creek trial burn with the aim of producing one petajoule of “syngas” a year.

Posted

by Big Gav

in

ctl,

gtl,

linc energy,

ucg

The Australian somewhat misleadingly reports that Linc Energy's UCG plant has started producing fuel, using what it calls a GTL (gas to liquids) process instead of the CTL (coal to liquids) process that it actually is - Linc shares spike on GTL news.

LINC Energy has started producing fuel at its gas-to-liquids project in Queensland, a world first according to the company. The project at Chinchilla involves the introduction of underground coal gasification (UCG) synthesis gas into a reactor that then produces high quality synthetic fuel.

Chief executive Peter Bond said his team had been working towards the gas-to-liquids (GTL) goal for the past two years. “Linc Energy has now proven that it can produce liquid fuels from UCG gas. This process provides the potential for billions of tonnes of stranded coal resources to be converted into transport fuels in an environmentally acceptable way,” he said. “And when you think that each tonne of coal equates to approximately 1.5 barrels of fuel, the potential of what Linc Energy has achieved today is simply enormous.” ...

Linc will continue to operate its GTL demonstration facility and use the experience gained to assist with finalising the engineering scope for the company’s proposed 20,000 barrel per day commercial facility, which is planned for commencement of construction in the next 12 months.

The company’s quest to spread its UCG technology around the world has also gained momentum. Vietnam's largest coal producer, Vinacomin, has signed a business cooperation contract with the Queensland gas-to-liquids hopeful and Japan's Marubeni Corp to extract gas from Vietnam's Red River Delta Basin The companies will start gas production on a trial basis from early 2009 using Linc Energy’s UCG process.

Posted

by Big Gav

in

australia,

coal to liquids,

ctl,

energie future,

ucg

I noted a little while back that UCG is losing out to CSM in Queensland. The SMH reports that a company is considering the idea of performing UCG (underground coal gasification - a coal to liquids process) on offshore coal deposits in New South Wales - Coal trial submerged in debate. Usually I'm all for ocean energy, but this isn't what I've got in mind.

UNTAPPED coal reserves under the Pacific Ocean could provide enough energy to power every house in NSW for about 13,000 years, a company that wants to explore a massive area under the seabed says. Energie Future is seeking leave to conduct tests under 5940 quare kilometres of the ocean floor between Newcastle and Wollongong.

If successful, the company would be the first in the world to use coal gasification - extreme heat to turn underground coal into gas - under the ocean floor.

The proposal has outraged Greens MP Lee Rhiannon, who said that even the exploratory work, centring on seismic testing, would endanger whales and other marine life. It would almost be inevitable that the Government would grant a mining licence to a company that had spent hundreds of millions of dollars on mining exploration, she said.

The MP, who is organising a protest at Bondi on Friday, said there was a "real threat of unforseen damage to the seabed and pollution and degradation to our coastal waters and beaches. Mining always follows exploration if the mining company wishes it, so this proposal should be ruled out now. The answer to climate change is investing in proven sustainable solutions like solar energy, not dangerous experiments that threaten our oceans and beaches," she said.

Posted

by Big Gav

in

china,

coal to liquids,

ctl,

linc energy,

ucg

While UCG may lose out to CSM in Queensland's coal fields, the unhealthy Chinese interest in coal to liquids (and plastics) continues unabated, with their latest move being an interest in taking Linc Energy's UCG technology to the Chinese coal fields - Linc inks UCG deal in China.

Linc Energy Ltd has signed a deal with Xinwen Mining Group to develop underground coal gasification (UCG) and gas to liquids (GTL) projects in China. The Queensland-based group has signed a letter of intent with Xinwen, the same company which agreed to acquire a package of Linc's Australian coal exploration permits for $1.5 billion.

The two companies have agreed to form a joint company to develop UCG fields to produce gas for transport to Shanghai through the west to east pipeline project, which is under construction. The joint company will also provide feedstock for a GTL facility to produce liquids that will be transported by pipeline to the Dushanzi oil refinery.

"This is an exciting development as Xinwen already has government approval for underground coal gasification," Linc chief executive Peter Bond said in a statement.

UCG is the process of extracting coal from the ground through its transformation into a combustible gas for power generation, or as a feedstock in the production of diesel or fertilisers.

Xinwen owns the Yinan and Yibei coal fields in the Yining mining area of China, which cover over 479 square kilometres and have a reported 15.37 billion tonnes of coal.

Posted

by Big Gav

in

china,

coal,

ctl,

pakistan,

plastic

My recent post on bioplastics had one commenter at TOD noting that China is looking at producing plastic from coal (and that Pakistan claims to have the world's 4th largest coal reserves).

Given China's interest in coal to liquids I thought this sounded like it could be true, and lo and behold - here's Green Car Congress reporting on "Siemens to Supply First 500MW Coal Gasifiers to China for Coal to Plastics".

Siemens Energy will deliver the first two of five coal gasifiers to Shenhua Ningxia Coal Industry Group Co. Ltd. (SNCG) in China. (Earlier post.) The coal gasifiers, each with a thermal capacity of 500MW, are destined for the Ningxia coal-to-polypropylene (NCPP) plant in Ningxia Province in northwest China.

After completion in early 2010, the plant with its five gasifiers will have an hourly production capacity of approximately 540,000 cubic meters of syngas, which will then be converted in downstream processes to polypropylene plastic.

The Siemens coal gasifiers, which are 18 meters long with an inside diameter of 3 meters and weigh 220 tonnes, are among the world’s largest and most powerful. They are capable of gasifying up to 2,000 tonnes of coal daily.

In the gasification process hard coal, lignite and other substances such as biomass, petcoke and refinery residues will be converted to syngas, and environmental pollutants such as sulfur and carbon dioxide subsequently removed. The syngas can then be used for power generation in integrated gasification combined cycle (IGCC) plants or as a raw material in the chemical industry, for example in the production of synthetic fuels.

The WSJ also has a look at coal to plastic in China -

Coal-to-Chemicals Projects Boom in China":

For years China has been a magnet for the chemicals industry, attracting European and American companies with its cheap production costs and growing market. Now China has another attraction for the energy-intense chemical industry: vast supplies of coal that can replace oil and natural gas as raw materials for chemical production.

In the last two years, China has built nearly 20 plants that convert coal into a gas that can be used to make such things as plastic and pharmaceuticals, according to the Gasification Technologies Council, an industry trade group. The new plants draw on technology developed by companies such as General Electric Co. and Royal Dutch Shell PLC.

Now, Western chemical firms are getting in on the action. Celanese Corp. opened a plant this year that uses coal-based feedstock to make a chemical used in paints and food sweeteners. Dow Chemical Co. has partnered with Chinese energy company Shenhua Group Corp. to study a project to convert coal into plastics. Mining company Anglo American PLC is also looking at a coal-to-chemicals project. Suppliers to the chemical industry, such as Praxair Inc., are vying to open accounts with the new coal-to-chemical plants.

"Coal to chemicals is an opportunity that's literally exploding [in China] right now," says Timothy Vail, chief executive and president of Synthesis Energy Systems Inc., a company that builds coal-gasification plants.

Launching their own coal-to-chemicals projects in China represents one way Western companies are fighting to keep their competitive edge. In the past decade, chemicals makers based in Europe and North America have lost market share to their counterparts in Asia, where demand for chemicals is rapidly growing.

China's government, meanwhile, has orchestrated the buildup of the coal-to-chemicals industry in an effort to reduce the nation's growing dependence on imported natural gas. Using China's vast coal deposits to make chemicals and plastics provides a more reliable source of raw materials that can feed the expansion of China's main economic growth engine, its manufacturing sector. The new plants also replace older, soot-belching chemical factories that have earned the government a bad reputation for the pollution they create in Chinese cities.

Gasification technology, which uses high temperatures and pressure to break the molecular bonds in coal to produce gases that can be recombined into a variety of fuels and chemicals, has existed for more than a century. Germany gasified coal to fuel its planes during World War II. China has made fertilizers through gasification for decades. But there had been little incentive for the global chemical industry to gasify coal until prices began soaring for natural gas and oil.

The Pakistani coal story also seems to check out, with the

Geological SUrvey Of Pakistan making some optimistic claims (

peak coal doomers would do well to note that coal data is pretty poor, and its likely that there is a lot more out there than they imagine).

Pakistan has considerable oil, gas, coal reserves; tidal, solar and hydel potential. It is ironic that Pakistan has fourth largest coal reserves in the world but it is importing 2.5 million tons of coal per annum for cement industry. At the same time, due to high cost of energy resources, the government has also decided to enhance the share of coal in the overall energy mix from 5 % to 18% up to 2018. Among the other alternative sources, coal is the man source for producing cheaper electricity and its availability is much higher. In view of anticipated shortfall of electricity and other energy resources during the next 10 years, demand for indigenous coal would grow in power generation considerably.

Pakistan has emerged as one of the leading country - seventh in the list of top 20 countries of the world after the discovery of huge lignite coal resources in Sindh. The economic coal deposits of Pakistan are restricted to Paleocene and Eocene rock sequences. Economists say that the energy demand over the next 5 years is expected to grow at a rate of 7.4 % per annum. It may be noted that in India the share of coal is as high as 54.5% in the total energy mix. To meet the future requirements of the country with indigenous resources, domestic exploration would have to be intensified to increase the share of coal from 5 to 25% by 2020. The GSP’s workshop provided a platform to highlight the role of the indigenous resources in the national economy especially in energy and industry.

Coal -the black gold, is found in all the four provinces of Pakistan. Country has huge coal resources, about 185 billion tons, out of which 3.3 billion tons are in proven/measured category and about 11 billions are indicated reserves, the bulk of it is found in Sindh province. The current total mine-able reserves of coal are estimated at 2 billion tones (60 % of the measured reserves). The speakers at this moot enlightened the audience with the importance of Thar coalfield and its development and utilization as less expensive fuel for power generation and other process industry. Because of Thar coal’s extraordinary importance for power generation, industrial development and economy, Sindh government and GOP are making all out efforts to develop this huge deposit for power purpose. It is one of the world’s largest lignite deposits discovered by GSP in 1992, spread over more than 9, 000 sq. kms. comprise around 175 billion tones sufficient to meet country’s fuel requirements for centuries.

For those of a conspiratorial bent, here's a Pakistani report accusing the oil companies of stymieing the development of the

Thar desert coalfields.

Advisor to Chief Minister on Mines and Mineral Department Dr. Khato Mal Jeewan while talking to The Nation said the Sindh government had invited proposals from companies interested in a project of open cast mining in Thar coalfield in a joint venture with equity participation of provincial government.

The provincial government made mandatory that preference would be given to those companies with sound financial position of at least US $ 200 million dollars in paid-up capital, and those which are dovetailed with power project of at least 1000 MWs. Advisor said the Board of Directors of Sindh Coal Authority will look into the offers submitted in return of invitation of provincial department and than short listed.

He did not confirm the acceptance of the offers of two national and international companies but said both are financially sound and well reputed firms. Dr. Khato Mal pointed out that PML-Q led previous provincial government without getting approval of Board of Directors of Sindh Coal Authority, had signed MoUs with 8 national and international firms for mining and other studies of coal reserves in Thar.

Out of 3-4 companies, the majority of them did not fulfill the requirement which they signed in Terms and References, Advisor said, informing that notices have been issued to those companies which proved default in fulfilling the TOR.

He alleged that Wapda, NEPRA, oil and generators’ importers mafia was the main hurdle in utilization of coals of Sindh because they are making billion of rupees profit in this business.

Referring to the recent studies of USA and other international companies which are working on coal mining in Thar, Dr. Jeewan said the utilization of only 25 billion tons of coal could fulfill the energy requirements of the country for next 200 years. He further said that Sindh had at least 175 billion tons lignite/coal reserves only in Thar but the Wapda and oil importers’ mafia making hurdles for delay in implementation of coal based power project.

From a global warming point of view none of this is very encouraging of course...

Posted

by Big Gav

in

australia,

cnooc,

coal to liquids,

ctl,

south australia

In my coal to liquids in Australia post a few months ago I rated the chances of a development in northern South Australia as low. The SMH has a report today that the chances have improved greatly with Chinese firm CNOOC indicating an interest in the project - Chinese oil firm targets coal-to-liquids. Just what SA needs - another coal fired power plant...

A subsidiary of a Chinese state-owned oil giant has thrown its weight behind an ambitious, $3 billion coal-to-liquids (CTL) project planned for South Australia.

Australia-focused energy minnow Altona Resources Plc, which is listed on London's Alternative Investment Market, has signed an in-principle agreement with CNOOC (Beijing) Energy Investment Co Ltd to cooperate in the development of Altona's Arckaringa project in SA. The project includes a 10 million barrel per year open cut mine and a 560 megawatt power plant.

Interest in CTL, which involves converting coal into liquid hydrocarbons, is growing amid concerns about "peak oil". ...

He said the project would provide a major new source of base load power and diesel to SA, "which has a significant looming power deficiency and currently imports all of its distillate requirements".

Posted

by Big Gav

in

coal,

coal to liquids,

ctl

The Australian reports that aspiring CTL (coal to liquids) and urea entrepreneur Allan Blood has grabbed a stake in the Crow CTL project in Montana I mentioned recently - Aussie coal deal with Montana's Crow tribe. As usual they are dreaming about a way of sequestering all the carbon dioxide produced.

WITH oil prices seemingly entrenched above long-term averages, Perth businessman Allan Blood has struck a deal with Montana's Crow tribe to look at building a $US7 billion ($8 billion) plant to turn their stranded coal reserves into diesel and jet fuel.

In a twist to local greenhouse gas capture schemes, Mr Blood plans to limit emissions from the project by selling carbon dioxide to Montana oil projects to inject into their fields and improve oil recovery.

If all goes to plan, the project will be profitable at oil prices above $US60 a barrel and could be producing 50,000 barrels daily by 2016. Mr Blood also has plans to develop a coal-to-urea plant in Victoria's La Trobe Valley.

The deal inked last week, calls for the Crow Nation to provide coal and water, and Mr Blood's unlisted Australian American Energy Co will provide funding and project management.

The coal will be mined above ground and converted to diesel using processes similar to those of South African synthetic fuels company Sasol.

Sasol's process produces more than twice the greenhouse emissions of a normal oil refinery, but the Montana project, known as Many Stars, will minimise these by either storing CO2 or selling it to nearby oil producers. "We're hoping to sell all the CO2 that gets trapped, as a by-product," he said. There were more than 8000km of dedicated CO2 pipeline in the US, he said.

Posted

by Big Gav

in

air transport,

algae,

biofuel,

btl,

ctl,

david strahan,

gtl

David Strahan has an excellent post on alternative fuels for the airline industry, highlighting the scale of the problem and pointing to some interesting fuel from algae experiments underway - Green fuel for the airline industry ? (hat tip Carbonsink).

If airlines are to have any chance of staying aloft in a post-peak, carbon-rationed world, they must quickly find an alternative fuel with low emissions that also matches the stiff technical standards of jet kerosene. Because planes have to lift their fuel into the sky and carry it for the entire journey, this fuel has to be energy dense. Because they fly at high altitude, it needs to remain fluid at -50 °C. Because they fly long distances, chemically identical supplies must be available all over the world. And because airliners have long lives, the new fuel must be compatible with the existing fleet. What’s needed, in other words, is an exact replica of old-fashioned jet kerosene – a so-called “drop-in” replacement – that also emits substantially less CO2 per unit of energy. “Meeting all these conflicting demands is a very tall order,” says Mike Farmery, global fuel technical and quality manager at Shell Aviation. “There are lots of exciting ideas, but it will be hard to achieve quickly.” So what are our alternatives?

Until recently it was widely thought that using biofuels like bioethanol or biodiesel in aviation was a non-starter. Scientists have known since the 1940s how to turn vegetable oil into biodiesel using a process called transesterification, in which the oil is processed using alcohol and an acid catalyst. This produces fuels that work well on the ground but not at altitude: the natural freezing point of such oils is too high, so they would congeal at 33,000 feet. They also contain too much oxygen, which adds weight but not energy content.

However, it now seems those technical problems have been cracked. Finnish oil company Neste has devised a way to produce an oxygen-free biodiesel called NExBTL, which could in theory be used to make jet fuel. Neste already has two plants manufacturing NExBTL and has another two in the pipeline.

Meanwhile in February 2008, airline Virgin Atlantic conducted a test flight using a biofuel made from coconut and babassu oil produced by Imperium Renewables, a Seattle-based company that has developed a patented method of reducing the freezing point. A second test flight with an Air New Zealand plane is planned later this year.

The problem with so-called first-generation biofuels – made using conventional fermentation and distillation procedures from wheat, say – remains the amount of feedstock and land required. During Virgin’s test flight from London to Amsterdam, the Boeing 747 consumed 22 tonnes of fuel, of which only 5 per cent was neat biofuel. Producing even that much required the equivalent of 150,000 coconuts, says Brian Young, Imperium’s director of international business development. Had this single flight been run entirely on biofuel, it would have consumed 3 million coconuts – an astronomical number that highlights the scale of the problem. However, Virgin and its partners Boeing and GE stressed that the flight was simply a “proof of concept”, and accepted that producing useful amounts of fuel would require “next generation” feedstocks: those made from non-food crops, waste biomass or by converting existing fuels to liquid form.

One option, which Virgin’s Richard Branson suggested at the launch of his airline’s test flight, would be to produce fuel from the nuts of Jatropha curcas. This hardy bush grows in the tropics on relatively poor land with little water or fertiliser, so it needn’t displace food production. However, the amount of land required to fuel the world’s jet planes would still be prodigious

Aviation currently consumes around 5 million barrels of jet fuel per day, or 238 million tonnes per year. On current Jatropha yields – 1.7 tonnes of oil per hectare – replacing that would take 1.4 million square kilometres, well over twice the size of France. To put this in context, D1 Oils, the British company pioneering biofuel from Jatropha in countries such as India, Zambia and Indonesia, plans to plant 10,000 km2 over the next four years.

If vegetable oil looks likely to remain in short supply, another approach would be to make jet fuel from plant material using the Fischer-Tropsch chemical process developed in Germany in the 1920s. Originally designed to produce synthetic diesel from coal, the Fischer-Tropsch process also works with a wide range of organic matter. The feedstock is heated without oxygen to create a synthetic gas that is then converted to high-quality liquid fuels using high temperatures and iron-based catalysts. This makes it possible to create a synthetic jet fuel that is indistinguishable from conventional kerosene. Depending on the feedstock, the fuel could in principle have very low carbon emissions and not compete with food production. Unfortunately, though, all the feedstocks have significant drawbacks.

For example, Fischer-Tropsch jet fuel is already produced from coal by Sasol in South Africa, and planes refuelling in Johannesburg get a half-and-half blend of kerosene and coal-to-liquids (CTL) fuel. The problem with CTL is that life-cycle emissions are roughly double those of kerosene, making CTL-powered aviation even more damaging to the climate.

The Fischer-Tropsch process also works with natural gas. Gas-to-liquids (GTL) jet fuel was tested by Airbus and Shell earlier this year. Well-to-wing emissions are lower than CTL, yet no better than conventional kerosene, because the Fischer Tropsch process itself consumes so much energy. According to Airbus’s rival Boeing, GTL jet fuel emits 1.5 times as much CO2 as kerosene.

The only realistic hope of producing Fischer-Tropsch jet fuel with substantially lower emissions is to use some form of plant material such as wood or straw as the feedstock – so-called biomass-to-liquids, or BTL – as championed by the German company Choren, which plans to start full-scale production by 2012. The company boldly proclaims a vision of “potentially infinite production of renewable energy”, but a closer look at the numbers suggests the real outlook will be more modest.

In a presentation at the World Future Energy Summit in Abu Dhabi in January, Choren CEO Tom Blades said the company’s BTL fuel could reduce greenhouse gas emissions by up to 91 per cent, and insisted it would not compete with food production. One reason for this is that a large proportion of the feedstock will come from waste construction timber and existing forestry – initially. However, Blades acknowledged that further BTL expansion would require increasing amounts of specially grown “energy crops” such as willow or miscanthus. Supplies of waste timber aren’t expected to grow, so within 10 years, more than half of Choren’s feedstock will need to come from energy crops, again raising the issue of land use.

Blades cites the EU’s Biomass Action Plan report of December 2005, which suggests that Europe has the potential to produce around 100 million tonnes of energy crops annually by 2030, and that total available biomass, including waste and forestry contributions, could amount to 315 million tonnes. Since Choren’s BTL process takes 5 tonnes of dry biomass to produce a tonne of fuel, this would produce just over 60 million tonnes of fuel per year. That sounds a lot until you remember that in 2006 the EU consumed more than 700 million tonnes of crude. “We’re not replacing oil,” Blades admits, “just making it last a little bit longer.”

In the context of global aviation, the numbers are even more daunting. Meeting today’s global demand for jet fuel from BTL would require – assuming the average crop yields 10 tonnes of biomass per hectare – nearly 1.2 million km2. That’s well over three times the size of Germany, and makes no allowance for the predicted rapid growth in aviation. On the same assumptions, replacing all current transport fuel with BTL would require more than 10 million km2 – an area bigger than China. This demolishes any claim that second-generation biofuels wouldn’t have to compete with food production.

The one remaining alternative for low-emission jet fuel that doesn’t compete with agriculture are algae, which can be grown in ponds of seawater built on non-productive land. Given the right conditions, some species multiply quickly and produce oil, which can then be extracted and refined. It is widely agreed that such a system could take up less space and deliver much higher yields than oil crops such as palm or Jatropha – although quite how much higher is still controversial.

The technology itself is not new. Ami Ben-Amotz, a senior scientist at Israel’s National Institute of Oceanography in Haifa, has been farming algae commercially for more than 20 years to produce beta-carotene food supplements for the Japanese market. In 2004 he founded a new company, Seambiotic, to produce algae for biofuel at a coal-fired power station on the coast at Ashkelon.

It is an undeniably neat arrangement. Warm water from the power station’s cooling system is diverted through the ponds before returning to the sea. Meanwhile flue gas from the station’s chimney supplies CO2 to feed the algae, and energy for pumping and harvesting is available at minimal cost. The harvested algae are then reduced to a concentrated paste and mixed with solvents to separate the oil, which can be turned into biofuel by transesterification. Seambiotic is delighted with the results and aims to complete a larger, 50,000-square-metre pond on the site by the end of the year. Ben-Amotz says that refineries could offer similar opportunities.

Algae have stirred up huge excitement, not only because they have the potential to help mop up CO2 emissions, but also because of the sheer amount of fuel they might produce. Shell, which is building a pilot facility in Hawaii, claims algae could be 15 times as productive as traditional biofuel crops. Boeing believes algae could produce 85 to 170 tonnes per hectare per year (10,000 to 20,000 US gallons per acre per year), yielding all the world’s jet fuel in an area the size of Belgium. Yet the scientists who have done most research into algae production look askance at such claims.

The fundamental problem, explains Al Darzins, who coordinates alga research at the US National Renewable Energy Laboratory in Golden, Colorado, is that although algae grow very quickly, most of their biomass is usually carbohydrate. To trigger a higher proportion of oil, you have to stress the algae in some way – starve them of nutrients such as nitrogen, say – which in turn limits their growth rate. As a result, Darzins thinks 42 tonnes per hectare is a more realistic target.

Posted

by Big Gav

in

coal to liquids,

crow,

ctl,

us

One problem I've long warned about related to peak oil is the surge of interest is that it will create in dirtier alternative fuels like coal to liquids plants. As a result, I haven't been surprised about the steady flow of news about planned CTL plants that is flowing from locations around the world, the latest from the US - Crow Tribe strikes deal for $7B coal project.

The Crow Tribe struck a deal Thursday with an Australian company toward building a $7 billion plant to convert coal into liquid fuels, which would be among the first such projects in the nation.

Capping months of negotiations, the Crow Legislature ratified a 50-year development agreement with Australian-American Energy Co., a subsidiary of Australian Energy Co.

The Many Stars coal-to-liquids plant initially would produce 50,000 barrels a day of diesel and other fuels. Construction would begin in several years and coal for the project would come from a mine yet to be developed by the tribe on the reservation, Crow leaders said.

The tribe's chairman, Carl Venne, said the coal-to-liquids project offered an unprecedented chance at improving the lives of the tribe's 12,000 members. The agreement calls for the Crow to receive up to 50 percent of profits from the plant after investors in the project recoup their costs.

"It means we will become self sufficient as a tribe," Venne said. "I won't need no more federal dollars. I won't need no more state dollars."

Total proceeds to the tribe could eventually top $1 billion annually — a breathtaking sum that dwarfs the Crow's current annual budget of about $26 million.

Representatives of the company and the tribe plan a public unveiling of the project at a news conference Friday. Expected to attend is Gov. Brian Schweitzer, who declined comment Thursday.

The Crow reservation sits atop some of the nation's largest coal reserves — an estimated 9 billion tons of recoverable resources. Yet only limited mining has occurred, and the tribe's economy remains hobbled by high rates of poverty and unemployment.

The development agreement comes as the coal industry faces rising criticism over its role as one of the largest sources of greenhouse gases blamed for global warming.

Hoping to defuse opposition, tribal leaders said the Many Stars plant would be built to capture 95 percent of the carbon dioxide it produces. That gas would be stored in underground geologic formations or sold to the oil industry, which pumps carbon dioxide into aging oil wells to squeeze additional production out of them.

Still, the fuel produced by such plants release carbon dioxide when burned, putting it roughly on par with conventional petroleum in terms of overall emissions, industry experts and government scientists have said.

Posted

by Big Gav

in

coal to liquids,

csm,

ctl,

queensland

One company I mentioned in my post on coal to liquids (CTL) last year was Linc Energy, who are trying to produce CTL using underground coal gasification (UCG) in Queensland. The Australian reports that the state government is having second thoughts about allowing UCG projects to proceed, instead seemingly preferring the rapidly expanding coal seam methane (CSM) industry - State lets off steam in coal gasification plans.

THE Queensland Government appears to be putting the brakes on its emerging coal gasification industry as it considers environmental concerns and whether the industry can co-exist with plans for a $20 billion LNG export industry.

Queensland's coal fields have attracted an investment bonanza in recent years as companies including Santos and Queensland Gas Company plan to use coal seam methane to develop a massive new LNG export industry, and other firms such as Linc Energy continue long-standing efforts to commercialise the entirely different coal gasification technology, which burns coal deep underground to extract a gas that can be liquefied into diesel and aviation fuel.

Federal Resources Minister Martin Ferguson has hailed both CSM and coal gasification as crucial to Australia's future energy security.

But the Queensland Government has realised that in several cases it has issued rights over the same tenements to companies pursuing each of the technologies -- even though most say they are incompatible because the coal gasification process burns the methane that the CSM producers are seeking to extract. And the Government now believes that in the long run the market will support the full-scale development of only one of the technologies, with cost and greenhouse emission levels from the production process the deciding factors.

"I expect both will develop until the market works out which one is most cost effective, but at the end of the day only one of these technologies will emerge as the winner on cost and greenhouse grounds," Queensland Climate Change Minister Andrew McNamara told The Australian.

In the meantime, as it seeks to sort out the problem of overlapping coal gasification licences issued under the Minerals Resources Act and CSM licences issued under the Petroleum and Natural Gas Act, the Queensland Department of Mines has sought advice from the Queensland Conservation Council and has heard deep concerns about the environmental impact of the coal gasification process, including its carbon emissions and claims that it could contaminate ground water.

The QCC told The Australian that it considered coal gasification a "more environmentally questionable resource" than CSM and had recommended to the Government that no UCG project should receive approval to commercialise in Queensland.

A spokeswoman for Queensland Mines and Energy Minister Geoff Wilson said the Government "has no intention of granting production tenures for underground coal gasification for at least three years. Underground coal gasification is a new technology, untried in Australian conditions, and it poses some potential problems, especially with groundwater systems," she said. "We will only do what is best for Queensland. In this case, we don't believe it's in the best interests of Queensland to grant production tenures for technology that is untried."

And Mr McNamara said his department had asked Linc Energy -- the most advanced of the coal gasification companies -- to perform new demonstration trials so that the Environmental Protection Agency could monitor emissions and groundwater quality. "Linc has been asked to do another more rigorous trial of its technology; it is critical we make sure we don't contaminate our groundwater," he said.

Linc CEO Peter Bond, whose company has a market capitalisation of $1.45 billion and has seen its share price rise from just 20c to $3.50 over the past two years, rejects the notion that his technology is incompatible with CSM performing stringent environmental assessments entirely of its own volition.

Posted

by Big Gav

in

coal to liquids,

ctl

Keith Johnson at the WSJ reports that the US may soon get its first coal to liquids plant, noting that one unfortunate side effect of high oil prices is that it makes both dirty and clean energy alternatives more attractive - Coal Juice: High Energy Prices Prompt First U.S. Coal-to-Liquids Plant.

It’s far from clear that higher energy prices are environmentalists’ friend. Though they migh eventually spur clean energy, they’re doing a good bit of the opposite right now.

Today’s energy prices—and just as importantly, growing concern over energy security—are driving ever-dirtier energy solutions, from Canadian tar sands, to a rush to develop shale oil and gas in the U.S., to a dash away from natural gas and back toward coal. The latest unintended consequence? America’s first coal-to-liquids plant, to be built in West Virginia.

Consol Energy and Synthesis Energy Systems, or SES, announced today they will build a smallish plant right next to a Consol mine that can turn abundant West Virginia coal into gas. Eventually, and with the help of ExxonMobil, the pair hope to crank out 100 million gallons a year of gasoline from the coal. Technology permitting, Consol and SES hope to one day stick the plant’s carbon-dioxide emissions underground, making it a “clean coal” gasification plant.

The pilot project responds to the two dirtiest words in America’s energy lexicon—“foreign oil”—with a politically, if not environmentally, appealing alternative—“domestic coal.” Both West Virginia senators love the idea, praising it as an answer to the state’s economic development and America’s quest for energy security. Environmentalists hate it.

Coal-to-liquids technology isn’t new—the process was developed in Weimar Germany in the 1920s. Apartheid-era South Africa used the technology to escape sanctions. Today, coal-rich and oil-poor China is leading the world’s charge to turn coal into industrial gases and transport fuel, though other countries with oodles of coal reserves—from the U.S. to Australia—are increasingly turning to the black stuff as an answer to the oil crunch.

Despite the complicated processes involved, the economics aren’t bad. Oil prices are high, and coal is still relatively cheap (and companies like Consol’s new partner SES can use the really cheap grades of coal.) Worse are the environmental impacts—burning the coal once to make a gas, which is then turned into gasoline, which is then burned again in cars. That’s the same charge levied against tar sands development—even though pricey oil now makes so-called dg“unconventional reserves” an economically—attractive project for oil companies, it takes a lot more energy to get the stuff out of the ground, leading to a lot more emissions of greenhouse gases.

Posted

by Big Gav

in

china,

coal to liquids,

ctl

Reuters has a slightly alarming (for those concerned about global warming) article on Chinese progress (and "ambitious" plans) for coal to liquids plants - China builds plant to turn coal into barrels of oil.

With oil prices at historic highs, China is moving full steam ahead with a controversial process to turn its vast coal reserves into barrels of oil. Known as coal-to-liquid (CTL), the process is reviled by environmentalists who say it causes excessive greenhouse gases.

Yet the possibility of obtaining oil from coal and being fuel self-sufficient is enticing to coal-rich countries seeking to secure their energy supply in an age of increased debate about how long the world's oil reserves can continue to meet demand.

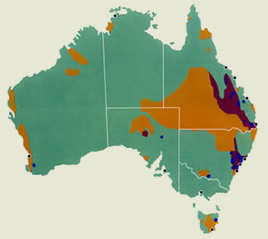

The United States, Australia and India are among those countries looking at CTL technology but are constrained by environmental concerns associated with the process which releases excessive amounts of carbon gases into the atmosphere and consumes huge amounts of water.

But China, which lacks the powerful environmental lobbyists that might stymie any widescale initiative elsewhere, is building a major complex on the grasslands of Inner Mongolia.

"Those countries with large coal reserves, like South Africa, China or the United States, are very keen on CTL as it helps ensure energy security," said Yuichiro Shimura at Mitsubishi Research Institute Inc (MRI) in Tokyo.

"However, the problem is that it creates a lot of carbon dioxide. Also you need a huge amount of energy for liquefaction, which means you end up wasting quite a lot of energy," the chief consultant at MRI in charge of energy told Reuters.

In Erdos, Inner Mongolia, about 10,000 workers are putting the final touches to a CTL plant that will be run by state-owned Shenhua Group, China's biggest coal mine. The plant will be the biggest outside of South Africa, which adopted CTL technology due to international embargoes on fuel during the apartheid years.

"We cannot fail," Zhang Jiming, deputy general manager at Shenhua Coal Liquefaction, told Reuters. "If things go smoothly, we will start with the expansion next year," he said.

The plant will start operating later this year and is expected to convert 3.5 million tonnes of coal per year into 1 million tonnes of oil products such as diesel for cars. That's the equivalent of about 20,000 barrels a day, a tiny percentage of China's oil needs as oil consumption in China is around 7.2 million barrels a day.

If all goes well, then Inner Mongolia will push on with an ambitious plan to turn half of its coal output into liquid fuel or chemicals by 2010. This would be around 135 million tonnes, or about 40 percent of Australia's annual coal output.

The region, as big as France, Germany and England put together, hopes CTL will propel development while contributing to Beijing's plan to have CTL capacity of 50 million tonnes by 2020.

That would be about 286,000 barrels a day, or about four percent of China's energy needs based on current consumption.