Junior ISAs: cash or stocks and shares?

If you’re thinking about saving for your child’s future with a junior ISA, you may be wondering whether to open one that saves in cash or one that invests in stocks and shares.

Putting money away for your little one is a long-term investment – if you start when they’re born, that’s up to 18 years of saving! So, when you’re opening a Junior ISA for your child, you’ll want to make sure you’re making the right choice for their future. It’s important to know the options available to you.

What is a junior ISA?

A junior ISA is an investment or savings account specifically for children. It can be opened for a child under 18 (under 16 if it’s a OneFamily Junior ISA) for the child, but anyone can pay into it – including grandparents, aunties and uncles and even family friends.

Only the child will be able to access the money and only once they turn 18, and as the junior ISA is a tax-efficient product they won’t have to pay tax on the money that they withdraw.

It could be the start of something even bigger, as your child can move the money into an adult ISA or lifetime ISA when they reach 18, so they can continue saving with the pot that you’ve built up over the years.

There are two types of junior ISAs, stocks and shares or cash. Both types can be used to build up a lump sum for a child, but the difference is how they grow. A cash junior ISA keeps your money saved in cash, meaning it grows by building interest like savings accounts do, while money in a stocks and shares junior ISA can be invested in company shares and other investment assets.

Investing in stocks and shares

OneFamily’s Junior ISA is a stocks and shares junior ISA. That means the money that you pay in goes into a fund that can be invested on your behalf.

"Investing" typically means paying your money into an investment fund along with other investors' money. The investment fund is used to buy various different types of investments: things like shares in companies, property and corporate and government bonds.

The value of the Junior ISA increases or decreases as the value of these assets changes. When your child withdraws their money, they'll "sell" the investments at their current price.

This gives your money good potential to outgrow interest rates and inflation, but there is a risk that in the short term its value could go down, which could mean your child getting back less than has been paid in. Investments can come with a variety of risks, and can range from high to low depending on where you are investing. Different funds have different risk ratings so it’s worth checking the fund risk rating if you open a stocks and shares Junior ISA and choosing a risk level you’re comfortable with.

With cash Junior ISAs, the amount of money in the account can’t go down. However, as prices go up (inflation), the same amount of money doesn’t buy as much as it used to. If the amount of interest the account earns is less than the rate of inflation (the amount prices go up by), then the money the child withdraws at 18 will be worth less than what was paid in.

Why do people choose stocks and shares junior ISAs over cash junior ISAs?

Stocks and shares Junior ISAs have good long-term growth potential when compared to cash Junior ISAs, where your money is protected but could lose value over time due to inflation. That means there’s greater potential for the money you pay in to grow by more than it would in a cash Junior ISA (although, of course, this isn’t guaranteed).

Although cash ISAs may appear at first glance to be the ‘safer’ option, as a junior ISA is left to grow for such a long time (up to 18 years), they are well suited to being invested.

More than 60% of junior ISAs are held in cash, but as a junior ISA is open long enough to ride out any periods of short-term volatility, it’s predicted that those with a cash junior ISA could be missing out on significant gains***.

***Source: TrustNet: Research from Wealth Manager - Quilter estimates that the UK’s children could have lost out on £3.4bn by sheltering in cash rather than investing in the stock market since Junior ISAs were first introduced in 2011.

See why OneFamily thinks investments are better in the long term:

How do stocks and shares perform?

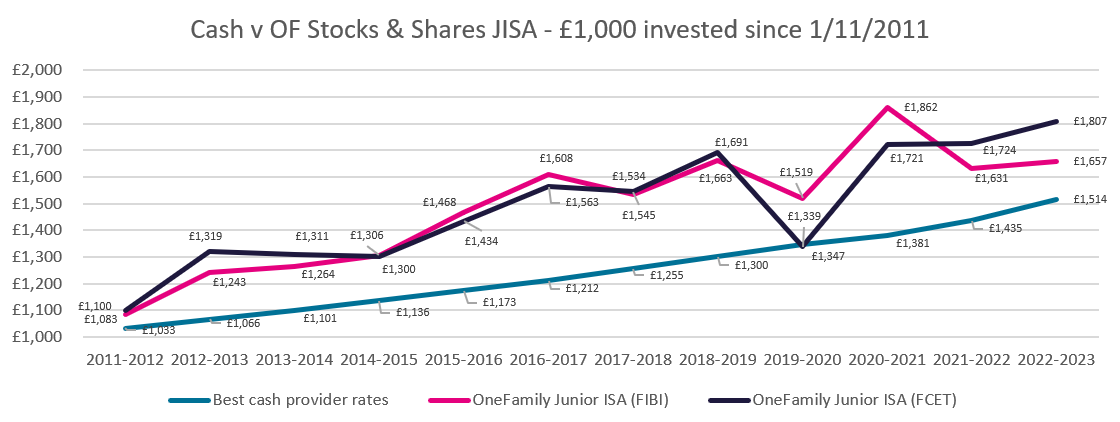

Since we released our stocks and shares Junior ISA in 2011, the cumulative growth has outperformed cash, almost every year. ****

The graph below shows how much £1,000 paid into a Junior ISA in 2011 would have grown by 2023 if it was paid into a cash Junior ISA or into one of OneFamily’s stocks and shares Junior ISA funds.

- If it was paid into a cash Junior ISA, it’s likely to have grown to £1,514

- If it was paid into OneFamily’s FIBI fund, it would have grown to £1,657

- If it was paid into OneFamily’s FCET fund, it would have grown to £1,807

Note: OneFamily’s Junior ISA comes with a choice of two funds: Family Investment Balance International Fund (FIBI) and Family Charities Ethical Fund (FCET). The performance of the two funds are shown separately on the above graph, compared to the best available cash provider rates****.

Due to the long-term nature of the Junior ISA account, you will typically have more time to ride out the ups and downs of the investment markets and typically do better stocks and shares account, for every 18-year period since 1960, stocks and shares have out-performed cash equivalents*. This is explained a little bit more in this video.

*Barclays Equity GILT study 2023

Let’s see how this looks for families.

The scenarios below compare two fictional parents**, with the same age child (7 years old) and both families paying in the same amount (£1,000):

Parent A: Mr Reynolds

Mr Reynolds took out a cash junior ISA in 2011 for his daughter Milly, who was 7 when the policy started.

Mr Reynolds invested a lump sum of £1,000 and didn’t add any further payments. He transferred the Junior ISA between a few different providers to keep up with the best interest rates.

When Milly turned 18, she cashed in the account to help pay for university. She had £1,435 in the account. So, the cash ISA created an extra £435 on top of the initial £1,000.

Parent B: Ms Biggs

Mrs Biggs took out a stocks and shares junior ISA with OneFamily for her son, Kevin who was also 7 when the policy started.

She invested a lump sum of £1,000 and didn’t add any further payments. Ms Biggs kept the stocks and shares Junior ISA with OneFamily the whole time.

When Kevin turned 18, he cashed in the account to use the money for his gap year abroad. He had £1,724 in the account.

So, the stocks and shares ISA created an extra £724 on top of the initial £1,000 invested.

Despite the same time period and the same amount of money paid in, Kevin received £289 more than Milly.

**These parents are for illustrative purpose only.

****Figures compiled by OneFamily estimating some of the best cash Junior ISA interest rates each year since launch in 2011. This provides a view of the best possible outcome customers could have achieved within a cash Junior ISA if they switched to the providers with the highest interest rates every year between 2011 and 2024. Customers that didn’t switch to the best market rates will have seen lower returns than shown here.

How much you could your child get?

Use our handy calculator to work out how much money your child could get when they turn 18.

The projection shows how your child's Junior ISA could grow with low, medium and high performance. Remember, projections are not guarantee of future performance and your child could get back less than you pay in.

You have a choice of two funds

As our Junior ISA invests in stocks and shares, its value can go down as well as up meaning your child could get less than was paid in.

When you open your OneFamily Junior ISA, you’ll be asked to choose which of these two funds you'd like to invest in:

Family Balanced International Fund

For more cautious long-term investors

Invest your money in a wide range of assets including company shares and property, as well as fixed interest assets to reduce your risk of loss. A wide range of investments includes companies in the UK, Europe, US, Far East and emerging markets.

Annual Management Charge of 1.5%Risk rating

Lower HigherYou can find out more about this fund in our Key Information Document and Fund Factsheet

Family Charities Ethical Trust Fund

For more adventurous long-term investors

Invest your money in the top 50 UK companies who focus on operating in a more sustainable way and ensure good supply-chain labour standards. Invests into sectors including pharmaceuticals, consumer goods and healthcare.

Annual Management Charge of 1.5%Risk rating

Lower HigherYou can find out more about this fund in our Key Investor Information Document and Fund Factsheet

Ready to get started?

Why invest with OneFamily?

We've over 45 years’ experience of being a trusted provider of financial products for children and adults, looking after over £5.5 billion for nearly 2 million customers.*

As a member-owned business, we want to have a positive impact on those around us. Our Inspiring Better Futures vision underpins our commitment to supporting our members and customers, creating an inclusive and diverse work environment and making a real difference in our communities.

Whether it’s offering affordable and accessible products to suit all types of savers, supporting our members with education grants, or giving back to our communities through charity partnerships and volunteering, our vision is at the heart of what we do.

*As at December 2022