Make your money more Monzo

Automate bills. Organise how you spend. Save in clever new ways.

Apply for a full UK current account in 10 minutes, for free.

UK residents only. Ts&Cs apply.

Get a fully regulated UK current account on Britain’s Best Banking App.

Make your account feel more you with custom Pots. Use them to separate your money, save, and sort bills.

Learn about your spending habits with weekly and monthly insights.

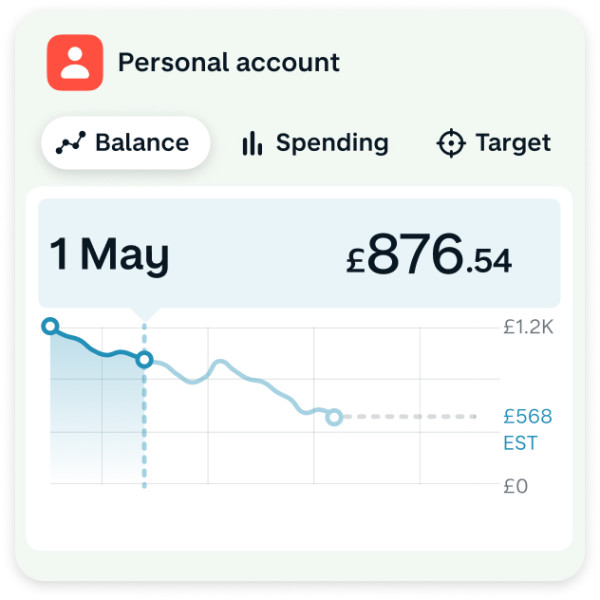

Get to know where your money goes

See instant notifications the second you pay. Then set budgets for things like groceries and going out, and get alerts if you’re spending too fast (if you want them).

Grow (and grow and grow) your money

Earn 4.10% AER interest (variable)

Paid monthly with an Instant Access Savings Pot or Instant Access Cash ISA. Deposit up to £100,000 with no minimum deposit, and access your money at any time.

Invest in your future

Invest as little as £1 in a choice of 3 investment options, and the experts will take care of everything for you.

The value of your investments could go up or down and you could get back less than you put in.

Save as you spend

Every time you spend money, we’ll round it up to the nearest pound and put the spare change in a Pot for you. All you need to do is switch on roundups.

People on Monzo save on average £100 extra each year this way.

Banish bill admin

Set up Direct Debits and standing orders to come directly from a Pot. So things like your council tax, Wifi and gas bill can come straight out of your Bills Pot.

We’ll also let you know if a bill’s more expensive than it was last month, so there’s no nasty surprises.

Spend with friends

We’ve been saving the nation from sending awkward ‘pay-me-back’ texts since 2018. Split bills, send payment reminders, and stay on top of joint costs.

We’ll work out who owes what and make it easy to settle up, even if someone’s not on Monzo.

Free yourself from travel fees

Get the real exchange rate

We don’t charge fees for spending on your card abroad, and we pass Mastercard's exchange rate directly onto you, without extra charges.

Stay in the know

You’ll see the real exchange rate in the app when you land. We'll also send you a spending report so you can look back on the cost of your trip.

Make free cash withdrawals

If Monzo is your main bank account, make unlimited fee-free cash withdrawals abroad in the European Economic Area (EEA), and up to £200 every 30 days for free outside the EEA. After that, we’ll charge 3%.

Speak to us wherever, whenever

We don’t have opening or closing hours. That means you can speak to a real-life human through in-app chat, whenever you need to, wherever you are.

Get more bank for your buck

Upgrade your personal current account based on what’s important to you. Here’s what you get with Max, our top plan:

Choose how you borrow money

Whether you need an overdraft to cushion your current account or a loan for bigger buys, we’ve got options.

We’re serious about your security

We use industry-first technology, like a tool that tells you whether or not you're speaking to a scammer in real time, to keep you safe. You can freeze your card instantly if you need to, or speak to one of our experts in-app if something doesn’t feel right.

Everything you want and need from your bank, in one hot coral package.

A fully licensed UK bank

That means we're regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Protection for your money

The Financial Services Compensation Scheme (FSCS) protects your eligible deposits in Monzo up to a value of £85,000 per person.

A better way to manage cash

With features like in-app cheque deposits, and cash deposits across all UK Post Offices and PayPoints.

24/7 customer support

We don’t have opening or closing hours. Message us in the app whenever you need help, wherever you need it.

Loans and overdrafts

We offer loans up to £25,000 and overdrafts up to £2,000. You can check if you're eligible without affecting your credit score.

Interest on your savings

Earn 4.10% AER (variable) paid monthly with an Instant Access Savings Pot. Deposit up to £100,000 with no minimum deposit, and you can access your money anytime.

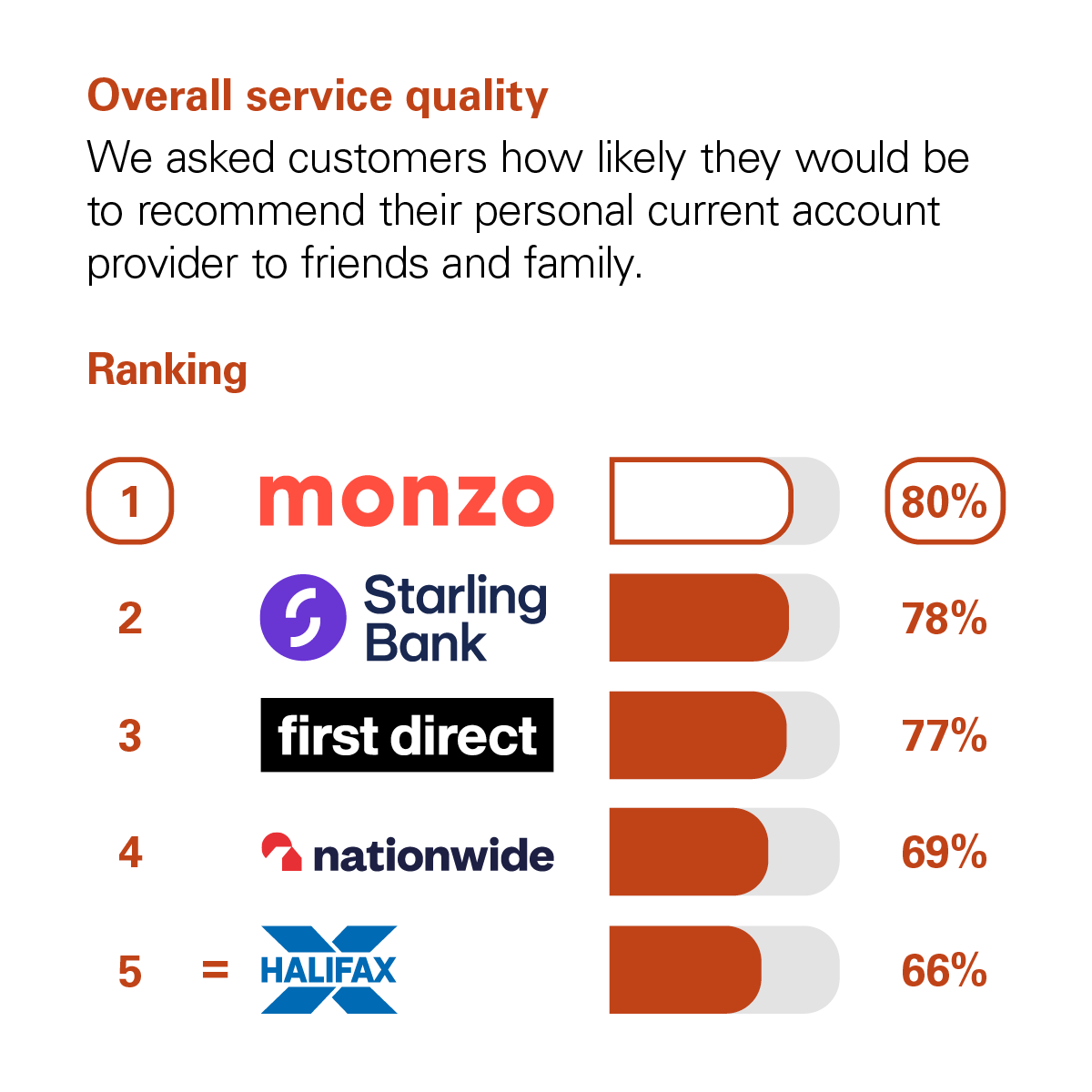

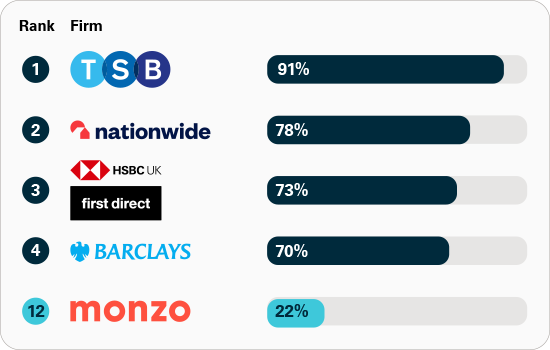

Independent service quality survey results

Personal current accounts

As part of a regulatory requirement, independent surveys were conducted to ask customers of the largest personal current account providers in Great Britain and Northern Ireland if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Authorised push payment (APP) fraud rankings in 2022

Authorised push payment (APP) fraud happens when someone is tricked into transferring money to a fraudster's bank account.

These charts use data given to the Payment Systems Regulator (PSR) by major banking groups in the UK in 2022.

You can read the full report by visiting www.psr.org.uk/app-fraud-data

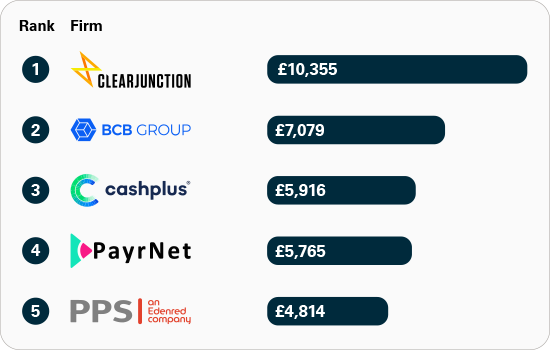

Share of APP fraud refunded

This data shows the proportion of total APP fraud losses that were reimbursed, out of 14 firms. Higher figure is better.

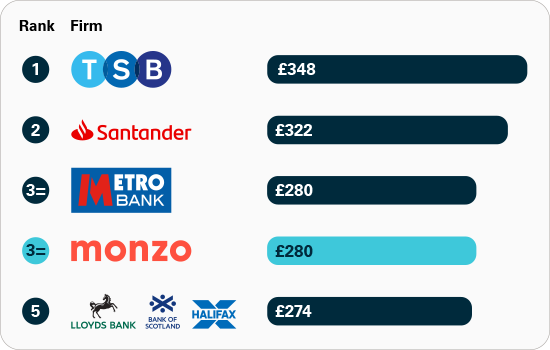

APP fraud sent per £million transactions

This data shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms. Lower figure is better.