Korea - Economy

South Korea's economy in 2020 ranked tenth in the world, despite the COVID-19 pandemic. According to the Ministry of Economy and Finance on 07 April 2021, the country in 2020 climbed up two ranks from 2019, surpassing Brazil and Russia. The top positions were once again held by the United States, China, Japan, and Germany. South Korea's GDP per capita last year also outpaced Italy for the very first time in 2020, reaching nearly US$31,500. The Finance Minister added that South Korea showed the least negative economic growth among developed countries amid the pandemic.

South Korea's economy in 2020 ranked tenth in the world, despite the COVID-19 pandemic. According to the Ministry of Economy and Finance on 07 April 2021, the country in 2020 climbed up two ranks from 2019, surpassing Brazil and Russia. The top positions were once again held by the United States, China, Japan, and Germany. South Korea's GDP per capita last year also outpaced Italy for the very first time in 2020, reaching nearly US$31,500. The Finance Minister added that South Korea showed the least negative economic growth among developed countries amid the pandemic.

Global credit rating agency Fitch Ratings revised down its growth forecast for South Korea, reflecting a new wave of the COVID-19 epidemic in the country. In its report on 08 September 2020, Fitch lowered its 2020 economic growth outlook for South Korea from minus 0.9 percent to minus 1.1 percent, though it maintained its assessment that the economic slump was less severe in South Korea compared to other countries. Praising South Korea's successful quarantine efforts amid the recent surge, Fitch said there was no need to enforce strict restrictions on the country's economic activities. Fitch also projected a steady recovery in the second half of the year, though private consumption will remain stagnant until the end of the third quarter because of social distancing.

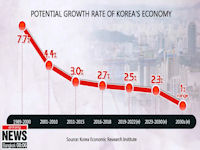

Korea's potential growth rate continued to drop and the situation wasn't likely to improve in the near future. The potential growth rate indicates how much a country could grow, without triggering inflation, if it used all of its given resources. A report 19 May 2019 from the Korea Economic Research Institute sees Korea's potential growth rate falling to 2.5 percent from this year through 2022. This is down from the previous period's figure of 2.7 percent. The institute points out that the figure decreased sharply after the Asian financial crisis of the 1990s and the global crisis a decade ago.

As for the grim figures for 2019, researchers point to a decrease in productivity on the supply side. This means that local companies are investing less in facilities and R&D than they used to. A separate report the same day from Hyundai Research Institute explained which industries are going through especially hard times in terms of facilities investment. The institute says none of Korea's main manufacturing industries are experiencing continued growth. For instance, the auto industry is experiencing a slowdown in investment in line with the first quarter's slower growth in production and shipment. In electronics, production and shipment actually shrank, also indicating a slump in investment.

By mid-2018 alarms were going off in the South Korean economy. The projected annual economic growth rate had slipped to 2.9 percent from 3 percent, but some institutions saw even 2.8 percent growth as a long shot. All economic indicators, including production, investment, export, consumption and employment, were worsening. One year and some months had passed since the administration of President Moon Jae-in was inaugurated, putting income-led growth as a primary policy with supplementary growth in innovation. That was enough time for economic policy to show its effect. Yet, the jobs situation, the area that has seen the most emphasis from the government, seemed to be worsening.

In April 2018, 402,000 tertiary-educated persons didn’t hold any job, comprising 36 percent of the 1.12 million unemployed. This was the largest proportion in history. Income-led growth, focusing on a consumption-led economy by enlarging earnings for low-income laborers, had revealed its limits in creating new jobs and achieving economic growth goals. The IMF and the OECD were calling for inclusive growth to relieve income inequality and achieve sustainable growth after the Great Recession that began in 2007/2008. Inclusive growth would emphasize building human capital and expanding educational opportunities to create jobs for vulnerable workers, as well as enlarging social security for the lowest income class.

South Korea's GDP is almost on a par with Canada and ahead of Russia; in 2016 its relatively new Hyundai (4.38 percent share) and sister Kia (3.69 percent) branded cars held over four times the market share of long-established Volkswagen (1.84 percent); and its Samsung cell phones, along with Apple, dominate the market. South Korea is no longer an imitator of mature products, it is now (data from 2015) among the top three countries granted US patents, behind only the US and Japan, and far surpassing Italy (17,924 vs. 2,645) for example.

In July 2017 Samsung Electronics recorded its largest quarterly profits in the company's 48-year history. The South Korean tech giant on 07 July 2017 posted its earnings estimate for the second quarter of the year, putting its operating profit at US$12.1 billion, up 72 percent on-year. This surpassed Apple's profit for this quarter, estimated at US$10 billion dollars. Samsung's sales revenue hit US$51.8 billion dollars, 18.6 percent higher than the previous quarter. Samsung is expected to overtake Intel as the global market leader in semiconductor sales. Intel had been the world's biggest chipmaker by revenue since January 1993.

The Republic of Korea (ROK) has made tremendous economic gains during the past four decades, transforming itself from a recipient of foreign assistance to a high technology manufacturing powerhouse and middle-income donor country in the span of two generations. Growth is expected to remain moderate in coming years, due to the ROK’s relatively developed economy, an aging population, and inflexible labor markets. Nonetheless, the ROK has so far weathered the global economic uncertainty and continues to remain a generally favorable destination for foreign investment.

However, many foreign -- and domestic -- firms continue to express concern with what is seen as an overly burdensome regulatory environment. Many regulations are unique to Korea and not consistent with global standards. The regulations are prescriptive and generally only allow activities that are explicitly authorized, thereby constricting the development of disruptive business models. Laws and regulations are often framed in general terms and are subject to differing interpretations by government officials, who rotate frequently. Regulations are sometimes promulgated with only minimal consultation with industry and with only the minimally required comment period.

Creating around half-a-million jobs and shaking loose roughly 40 billion U.S. dollars worth of investment are among the goals set forward by the government on 18 February 2016 as it announced a new set of measures this week to prop up investment. Out of around 120 tasks included in the fresh measures, about one-fifth required revisions to related laws. With a number of economy-related bills already being held up at the National Assembly, and political parties stuck in gridlock, making these amendments looked more than challenging.

Korea's jobless rate rose in January 2016 due to seasonal factors. Statistics Korea said the unemployment rate stood at 3.7%, up from 3.2% in December 2015 and 0.1% lower compared to the year before. The number of employed people stood at 25,400,000 in January 2016, with 339,000 new jobs being created from a year before. The eleven-month low in the number of new jobs was attributed to the cold weather preventing the agriculture and fishery sectors hiring more people. The seasonally adjusted jobless rate remained unchanged from a month ago at three.five percent. The youth unemployment rate rose to a seven-month high of 9.5% in January 2016, compared to 8.4% in December 2015.

By early 2015 the hoped-for output recovery had not materialized — domestic demand remained sluggish and inflation low and external uncertainties have increased. More fundamentally, relatively weak non-manufacturing productivity was accompanied by a heavy, and likely unsustainable, reliance on manufacturing exports for growth while also leaving the economy more exposed to external shocks, and the demographic headwinds from a rapidly aging population were beginning to build.

Sustaining longer-term growth and reducing external imbalances call for structural reforms to address low service sector productivity, support a more dynamic corporate and SME sector, and remove barriers that lead to underutilized labor. Maintaining a flexible exchange rate is essential both as a buffer against external shocks and to facilitate adjustment toward domestic sources of growth and thereby reduce external imbalances.

To avoid falling into low-growth, low-price spell, in 2015 the Korean government deployed a combination of macro expansionary policies and micro reinvigoration plans – a 22-trillion dollar worth of fiscal stimulus package with supplementary budget and various policies to boost consumption and tourism. The government also prepared an expansionary budget for the next year to keep the hard-earned recovery momentum going. It aimed to achieve medium and long term fiscal soundness by creating a virtuous circle of the economic recovery from the fiscal expansion and the resulting increase in the government revenues.

Korea pushed for full-scale four-sector reforms in labor, finance, education and public sector. In particular, it planned to drive visible results – which span from productivity and growth potential improvement to job creation – by carrying out result-oriented, performance-centric reforms based on shared understanding that has been forged.

Korea was the world's sixth-largest exporter in 2015, moving up a notch from the year before despite the sluggish global economy and low global oil prices. According to the World Trade Organization on 18 February 2016, Korea's exports amounted to 527-billion US dollars in 2015, putting the country in sixth out of the 71 exporters surveyed. China topped the list with 2.27 trillion US dollars, followed by the US with 1.5 trillion and Germany with 1.3 trillion.

South Korea experienced real GDP growth of 3.3 percent in 2014, a slight increase from 2013’s 3 percent, but lower than the 3.9 percent originally targeted, largely because of a decrease in domestic consumption and investment due to national malaise in the wake a tragic ferry sinking and slower growth in many of its export markets.

From a year earlier, in the third quarter of 2014 the Korean economy expanded 3.2 percent, the slowest pace in more than a year. And Korea's traditional growth engine -- exports slipped 2.6 percent in the third quarter from the previous quarter, while the output in the country's manufacturing sector dropped zero.9 percent. That marked the first drop in five and a half years. The central bank cited the sluggish global economy and the recent poor performance by some of Korea's major conglomerates like Samsung Electronics as major reasons.

Korea - Economy Background

Over the past several decades, the Republic of Korea achieved a remarkably high level of economic growth, which has allowed the country to rise from the rubble of the Korean War into the ranks of the Organization for Cooperation and Development (OECD). Today, South Korea is the United States' seventh-largest trading partner and is the 15th-largest economy in the world.

In the early 1960s, the government of Park Chung Hee instituted sweeping economic policy changes emphasizing exports and labor-intensive light industries, leading to rapid debt-financed industrial expansion. The government carried out a currency reform, strengthened financial institutions, and introduced flexible economic planning. In the 1970s Korea began directing fiscal and financial policies toward promoting heavy and chemical industries, consumer electronics, and automobiles. Manufacturing continued to grow rapidly in the 1980s and early 1990s.

In recent years, Korea's economy moved away from the centrally planned, government-directed investment model toward a more market-oriented one. South Korea bounced back from the 1997-98 Asian financial crisis with assistance from the International Monetary Fund (IMF), but its recovery was based largely on extensive financial reforms that restored stability to markets. These economic reforms, pushed by President Kim Dae-jung, helped Korea return to growth, with growth rates of 10% in 1999 and 9% in 2000. The slowing global economy and falling exports slowed growth to 3.3% in 2001, prompting consumer stimulus measures that led to 7.0% growth in 2002. Consumer overspending and rising household debt, along with external factors, slowed growth to near 3% again in 2003. Economic performance in 2004 improved to 4.6% due to an increase in exports, and remained at or above 4% in 2005, 2006, and 2007. With the onset of the global financial and economic crisis in the third quarter of 2008, annual GDP growth slowed to 2.3% in 2008 and just 0.2% in 2009.

Economists are concerned that South Korea's economic growth potential has fallen because of a rapidly aging population and structural problems that are becoming increasingly apparent. Foremost among these structural concerns are the rigidity of South Korea's labor regulations, the need for more constructive relations between management and workers, the country's underdeveloped financial markets, and a general lack of regulatory transparency. Korean policy makers are increasingly worried about diversion of corporate investment to China and other lower wage countries, and by Korea's falling foreign direct investment (FDI). President Lee Myung-bak was elected in December 2007 on a platform that promised to boost Korea's economic growth rate through deregulation, tax reform, increased FDI, labor reform, and free trade agreements (FTAs) with major markets. President Lee’s economic agenda necessarily shifted in the final months of 2008 to dealing with the global economic crisis. In 2009, the economy responded well to a robust fiscal stimulus package and low interest rates.

Two-way trade between North and South Korea, which was first legalized in 1988, rose to almost $1.82 billion in 2008 before declining sharply thereafter. Until recently, South Korea was North Korea's second-largest trading partner after China. Much of this trade was related to out-processing or assembly work undertaken by South Korean firms in the Kaesong Industrial Complex (KIC). Much of the work done in North Korea has been funded by South Korea, but this assistance was halted in 2008 except for energy aid (heavy fuel oil) authorized under the Six-Party Talks. Many of these economic ties became important symbols of hope for the eventual reunification of the peninsula. For example, after the June 2000 North-South summit, the two Koreas reconnected their east and west coast railroads and roads where they cross the DMZ and improved these transportation routes.

South Korean tour groups used the east coast road to travel from South Korea to Mt. Geumgang in North Korea beginning in 2003, although the R.O.K. suspended tours to Mt. Geumgang in July 2008 following the shooting death of a South Korean tourist by a D.P.R.K. soldier. Unfortunately, North-South economic ties were seriously damaged by escalating tensions following North Korea’s torpedoing of the South Korean warship Cheonan in March 2010. In September 2010, South Korea suspended all inter-Korean trade with the exception of the Kaesong Industrial Complex. As of mid-November 2010, economic ties had not seen signs of revival.

|

NEWSLETTER

|

| Join the GlobalSecurity.org mailing list |

|

|

|