FuturePlay Games relies primarily on advertising to monetize. But it had a devil of a time attributing ad revenue to specific campaigns.

FuturePlay Games relies primarily on advertising to monetize. But it had a devil of a time attributing ad revenue to specific campaigns.

“We knew that an ad had been watched on a device, but we didn’t know how much money we got back from it,” said Camilo Fitzgerald, a games analyst at the Helsinki-based game developer, founded last year by an Angry Birds exec.

FuturePlay has two games under its belt and more than 2 million monthly active users.

To try and get a handle on attribution, FuturePlay turned to AppsFlyer. The mobile analytics and measurement platform launched a tool out of beta on Wednesday that analyzes in-app ad revenue against marketing activities to help app publishers better understand users’ lifetime value (LTV).

It works like this: AppsFlyer gets revenue numbers for its developers in specific geos over specific periods of time that it matches with ads viewed by device in addition to in-app event purchase revenue.

If a developer earned $1,000 on a particular day, for example, and AppsFlyer saw 10,000 ad views, each ad view is worth about 10 cents plus whatever revenue was generated through other in-app events by users acquired through an ad network.

AppsFlyer also takes geo into account because an ad view in one country, say the US, is often more valuable than a view in another.

The ad revenue attribution tool is available through AdMob, AppLovin, AdColony, Chartboost, ironSource and Unity Ads.

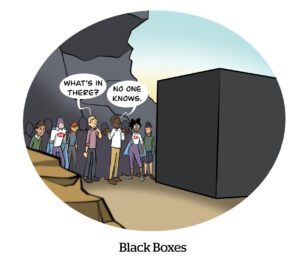

Ad revenue was previously an attribution black hole, said Jon Burg, product marketing lead at AppsFlyer.

“The marketing team just didn’t have insight into the ad revenue side of things,” Burg said. “The only insights they had were into things like in-app purchases, app purchases, subscriptions – direct revenue sources. What we’re doing here is adding in the ad revenue sources that provide them with a full LTV picture and allow them to optimize based on bottom-line ROI and business impact.”

App Annie recently predicted that mobile in-app advertising would increase from just over $50 billion this year to $117.2 billion in 2020, accounting for 62% of total app revenue.

“We’re starting to see in-app ad revenue take a larger piece of the LTV pie, which means publishers increasingly need insight into their advertising,” Burg said.

Attributing ad revenue back to the acquisition media source and the campaign has been “the missing piece,” said Matan Tessler, director of product management at AppsFlyer.

Tying ad revenue to the source is particularly important for a game publisher like FuturePlay, which has eschewed the free-to-play model of in-app purchase-driven revenue for what it calls a “view-to-play” model centered on rewarded video.

An in-app purchase is a discrete and trackable event, “but we were having to take the average revenue from ads per daily active user and multiply them out to figure out how much revenue we were making per user group,” Fitzgerald said. “It was a pain point. There could be one set of players watching loads of ads, but we just weren’t able to attribute it back.”

Since starting to use the tool, FuturePlay has been able to reallocate its budget and focus on networks with better results.

For example, AdColony was always a pretty decent buy for FuturePlay, pulling in users with slightly higher-than-usual retention rates, so FuturePlay felt confident nudging its spend up by 5% or 10%.

But after running a deeper analysis with AppsFlyer, it found that the users coming in from AdColony also provided more attributable ad revenue in addition to better retaining users. As a result, FuturePlay increased its spending by between 30% and 50% and its volume between two and three times, depending on the campaign and geo.

By the same token, FuturePlay has pulled back spend and volume going through other networks.

“Without this data, we wouldn’t have known in such detail that we were ROI-positive on these events,” Fitzgerald said. “It helps networks bid more competitively and it helps us with user acquisition, to find pockets of users or a particular channel that brings in a lot of revenue so we can increase our bids and be able to compete ourselves.”