What’s in this report

About this report

Welcome to the 9th edition of the Inside Australian Online Shopping Report, an in-depth study into consumer buying behaviours and trends.

To provide insights into the current and future state of commerce, this report uses information from a range of sources, including delivery data from the Australia Post Group.

Forward

Welcome to the 2024 Australia Post eCommerce Industry Report

In 2023, we saw a period of moderation in retail activity as Australian consumers and retailers adapted to changed economic conditions.

Executive Summary

Online retail is here to stay

State of

Commerce

Dive into the shopping carts of Australian consumers as we uncover the surprising insights from online and in-store spending data in 2023.

How did retail do in 2023?

Growth in retail spend decelerated in 2023, with year-on-year (YoY) growth dropping from an exceptional 9.3% to a modest 2.0%4, below the pre-COVID average.

This shift presented considerable challenges for both retailers and consumers. Consumers were strategic with their purchases and showed a hesitancy to spend, particularly on non-essential items. For the first time in five years, non-discretionary spend growth outpaced discretionary spend growth5.

Retailers did their best to adapt. Some adopted long-term initiatives to drive down costs and improve productivity, while others offered deeper discounting in the short term to manage inventory and boost foot traffic.

Looking ahead, interest rate adjustments, moderating inflation6, predicted income growth7 and stage three tax cuts are expected to ease economic challenges and enhance consumer spending power by an estimated $50 billion in FY 20257. Coupled with population growth, these factors are anticipated to drive overall growth and provide some relief for retailers by the end of 2024.

What did we spend online?

Spending may be flat but we’re shopping online more often

Consumers chose to make more frequent but smaller purchases, with an average basket size of $98.10, down by 4.6% from last year8.

As people looked for better deals, Variety Stores, especially Online Marketplaces, saw a surge in online spending, up by 9.1%8. The only other type of store to see growth in 2023 was Food & Liquor, mostly because more people were buying groceries online.

- Spend Share (%)

- YoY Change (%)

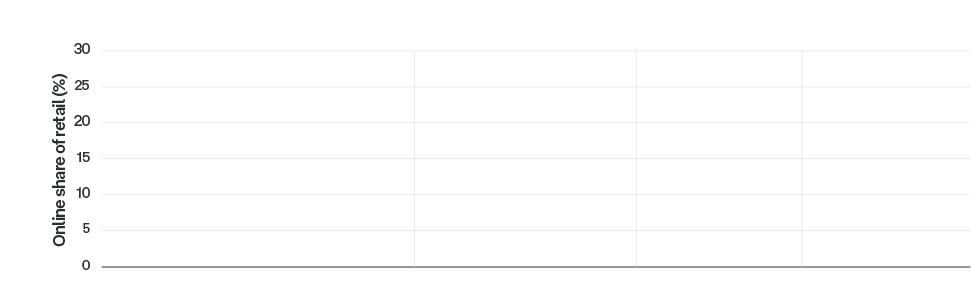

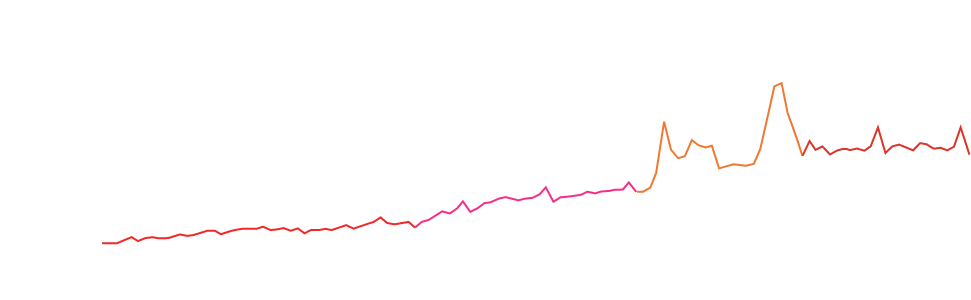

The evolution of eCommerce in Australia

Even though growth in online shopping seems to have slowed after the COVID-19 pandemic, eCommerce continues to hold a significant portion of total retail spending.

Retailers have been focusing on creating smooth shopping experiences that blend online and in-store options to attract customers back to physical stores. However, it’s clear that online shopping continues to be an essential part of the Australian retail landscape.

Online share of retail spend:

More households are shopping online

than ever before

8 in 10 Australian households shopped online in 2023. That’s 9.5 million households (+1.4% YoY) across the nation that received a parcel in 2023.

We’ve seen significant progress over the years. Compared to 2019, there are now an additional 1.5 million households choosing to do their retail shopping online. In 2023, on average there were 5.6 million households that made an online purchase each month.

Regional areas outpacing metro growth

In the past few years, rural areas have seen more growth in households shopping online than metro areas. They’ve experienced a significant 18% increase since 2019, while metro areas have seen a 16% growth rate.

Aussies are purchasing online more often

Approximately 1 in 7 Australian households made weekly online purchases, illustrating the growing reliance on eCommerce in everyday life.

Repeat purchasing intensified, as the number of purchases per household went up. Households that shopped 26-51 times a year increased by 2% while the group of most frequent shoppers, who made over 52 purchases annually, increased by 1%.

Handy Hint

Offer frequent shoppers personalised experiences to build loyalty, improve customer satisfaction and encourage repeat purchases.

Frequency of online purchases per year

Where are we seeing the greatest growth?

Western Australia led the way in 2023 with the highest YoY growth in online purchases (5.1%).

The Northern Territory, though often under-reported on, came in second with an impressive 4.6% growth in online purchases.

Queensland and Tasmania also did well, each with 4.3% growth. South Australia joined in with a 2.8% increase, reinforcing the nationwide move towards online shopping.

However, in Victoria and New South Wales – which are big economic players – there was a downturn in the amount people bought online. Victoria’s online purchases decreased by 1.0% and New South Wales saw a 2.1% drop. These decreases seem to match a trend where online shopping is going back to normal after an unprecedented surge during the COVID-19 pandemic.

State growth

Top locations for online shopping

Top locations by volume

- Point Cook VIC3030

- Toowoomba QLD4350

- Point Cook VIC3029

Top locations by volume per capita

- Macleay Island QLD4184

- Mount Duneed VIC3217

- Mooloolah Valley QLD4553

Top growth suburbs by volume

- Fraser Rise VIC3336

- Waterford West QLD4133

- Woodford QLD4514

How sales events are transforming the eCommerce landscape

Online sales events accelerated in popularity in 2023, becoming almost like traditions for Aussie shoppers.

The year’s standout event, Black Friday, saw a huge 88% leap in number of online purchases compared to 2019, as shoppers turn to sales events for the best deals. Cyber Monday also did well, with a 70% volume increase over 2019. Boxing Day and End of Financial Year Sales (EOFYs) also saw significant growth, with 67% and 75% volume increases since 2019, respectively.

Across the Generations

The eCommerce world continues to evolve, with more opportunities predicted for 2024. Here’s what you should know to stay competitive in a challenging market.

Consumer spending by generation

Online spending totalled $63.6 billion in 20238. But when we dig deeper, there are surprising insights to be found about the shopping habits of each generation.

In today’s economy, younger generations are cutting back in response to challenging financial conditions. With uncertain job markets and increasing debt, they’re choosing smaller, budget-friendly purchases like fast fashion and affordable lifestyle products.

Meanwhile, older generations, with stable finances and established careers, continue to spend generously – particularly on home and garden items. This highlights a clear generational gap in spending habits driven by economic conditions and priorities.

Gen Z

- Ages in 2024: 18 – 26

- Birth years: 2006 – 1998

Total online spend:$10.6b

YoY change in online spend:-11%

Average basket size for online spend:$80

YoY change in basket size:-6%

Gen Y

- Ages in 2024: 27 – 43

- Birth years: 1997 – 1981

Total online spend:$22.1b

YoY change in online spend:-2%

Average basket size for online spend:$95

YoY change in basket size:-6%

Gen X

- Ages in 2024: 44 – 59

- Birth years: 1980 – 1965

Total online spend:$17.5b

YoY change in online spend:+1%

Average basket size for online spend:$110

YoY change in basket size:-5%

Baby Boomers

- Ages in 2024: 60 – 78

- Birth years: 1964 – 1946

Total online spend:$12.5b

YoY change in online spend:7%

Average basket size for online spend:$109

YoY change in basket size:-3%

Which categories do the generations prefer?

How the generations shop

All value sustainability, younger shoppers (like Gen Z and Gen Y) switch for faster delivery and Boomers are warming up to online shopping.

Gen Z (18-26)

Tap into Gen Z’s passion for the environment by clearly stating your sustainability goals on your website. Offering a seamless returns policy will attract them, too.

Loves shopping online, with 21% of their purchases happening on the internet8.

93%would rather shop from brands that align with their sustainable values.

67% are the masters of switching retailers for a faster shipping thrill!

16% value the convenience of adding Parcel Locker locations in the Australia Post App2.

51% are riding the return wave, indicating a strong inclination for sending items back.

Gen Y (27-43)

For enthusiastic Gen Ys looking for a quick parcel delivery, consider offering Australia Post’s Metro or Express Post delivery options at checkout for expedited shipping.

The online shopping champions, spending 23% of their retail budget online more than any other generation!8

82%prefer shopping from brands that match their sustainable values.

57% feel the need for speed and are ready to switch retailers for faster shipping.

24% love the ability to rename their deliveries in the Australia Post App (with so many parcels, no wonder!)2

44% are embracing the return game, opting to send items back.

Gen X (44-59)

Appeal to value-driven Gen Xs by offering free shipping promotions, particularly around a certain spend, and clearly communicate these incentives to encourage larger purchases.

Demonstrates an interest in online shopping, with a steady online spending rate of 19%8.

66%care about shopping from brands that align with their sustainability values.

Just 31% are up for the retailer-switching game in pursuit of faster delivery.

34% highly value the push notifications and real-time updates from the Australia Post App2.

34% are riding the return wave, indicating a strong inclination for sending items back.

Baby Boomers (60-78)

Build trust by creating a fully accessible and easy end-to-end experience on your website. Including a note about data security at checkout gives Boomers added confidence to shop online, too.

Gradually embracing online shopping with 14% of their retail purchases now made online8.

63%will opt for brands that match their sustainability values.

A mere 17% are ready to shake things up and switch retailers for a taste of faster delivery.

63% find the ability to automatically track parcels in the one spot the most important feature of the Australia Post App2.

21% are returning items to retailers, with the majority sticking with their purchases.

Trends in eCommerce

The eCommerce world continues to evolve, with more opportunities predicted for 2024. Here’s what you should know to stay competitive in a challenging market.

What if returns were a good thing for business?

Nearly 76% of online shoppers read the website’s return policy before placing an order2, suggesting a seamless return policy is an important factor in their decision-making process.

That’s why it was surprising when ASOS Australia quietly introduced an $8.99 AUD return fee in mid-2023, following the likes of international brands such as Zara and Boohoo. We know about the high cost of returns to retailers – but while applying a return fee is one option, there are ways return policies can actually become a profitable part of your business.

Using loyalty to mitigate returns

With 78% of Australians agreeing loyalty programs enhance their experience with a brand11, retailers recognise the economic value of building loyalty into their strategy. “Making sure that we have happy, loyal Linen Lovers is a huge priority for us. We know that our Linen Lovers spend more on average, visit stores more on average, and shop online and in-store more as well,” says Emma.

Not only that, but common loyalty perks – like free and extended returns – help to build brand trust, resulting in happy customers and often, less returns in the long run.

Communicating your policy

Providing a transparent and accessible returns policy also serves as a proactive measure to build brand trust. According to Emma, it’s all about communication: “The key is having the conversation at the right time,” she says.

By addressing the returns policy at vital touchpoints in the customer journey, you empower shoppers to make informed decisions. Briefly outline your returns policy during the checkout process or send a post- purchase email with a friendly reminder. Presenting the policy through an infographic or step-by-step guide will also make it more user-friendly.

Did you know:

of Australians agree loyalty programs enhance their experience

Handy Hint

Consider offering rewards for members who make fewer returns or use customer data to tailor return policies to individuals.

Read more about the Adairs business story

With satisfied customers comes a ream of other benefits – like less need for returns.

Creating an omnichannel presence through pop-ups

of businesses found an omnichannel presence improved customer engagement1. However, traditional shopfronts aren’t the only option.

While we may be seeing some retail giants implement return fees on postal and collection point returns, free in-store returns continue to be a vital tactic for boosting foot traffic. We know this omnichannel strategy works – in fact, 90% of online-only small to enterprise businesses are considering a physical presence in the next two years1. But as rental costs soar, what are some alternatives that require less long-term investment?

From local markets to global marketplaces

Rikki Gilbey, Australia Post 2023 Local Business Hero and founder of WAW Handplanes, explains how his start at Manly Markets provided the perfect, low-risk opportunity to showcase his product in front of a live audience. After his first market stall, he immediately sold out.

“The markets are on the beachfront, so I knew that our potential customers would be there already. It’s also a popular spot. I thought it would be a great place to test-run our products in front of our potential target audience and see what they thought,” says Rikki.

Post Office pop-up helps small business grow

Since the launch of Pop Up @ Post at the reimagined Orange Post Office in NSW last October, we’ve already seen various small businesses in the local community benefit from the exposure. The rotating marketplace is being rolled out across the country and allows different brands to showcase their products in-store each season.

“It was my first real market research, putting the handplanes in front of strangers’ faces. You don’t get that immediate feedback online.”

Now, WAW Handplanes are stocked in over 50 surf shops across Australia, as well as stores in the US, France, Peru and Indonesia, and sold on Amazon AU and US.

Handy Hint

Create memorable moments at your market or pop-up – like a selfie wall, neon sign or freebies – to encourage shoppers to share on social media.

Read more about the WAW Handplanes story

To be honest, those markets (Manly) were the inspiration that fuelled the fire to start this business.

Final sale items and the recommerce revolution

of businesses use ‘final sales’ in their strategy1, and yet this cost-saving tactic presents opportunities for both retailers and consumers alike.

Final sale items offer savvy shoppers a golden opportunity for bargains and help businesses clear inventory. Beyond that, the sense of urgency created by such sales can drive fast purchases and prompt customers to explore products they might not have considered otherwise. However, a ‘no returns’ policy poses a dual risk: inconvenience for consumers when the purchased item is unsuitable, and environmental harm when these items reach landfill.

Promoting a circular economy

Women’s clothing brand, birdsnest, predicted this trend back in 2021 and in striving to deliver an exceptional customer service, introduced rehatched – a dedicated resale platform promising customers a lifetime returns guarantee and access to preloved styles alongside current-season offerings.

Birdsnest Founder Jane Cay explains:

“Rehatched is part of us taking responsibility for the clothing we bring into the world. Our goal is to make participating in a more circular fashion economy simple, fun and convenient for our community as that will naturally change shopping habits and extend the life cycle of our clothes.”

For brands looking to launch a resale program,

it’s important to start with a meticulous strategy that considers technology, stock acquisition, ongoing resources, logistics and marketing. There will be challenges but plenty of business benefits too – like diversifying your revenue stream without relying on a global supply chain, and taking back revenue otherwise lost to third-party resale platforms. Not to mention, appealing to shoppers seeking sustainable brands.

Handy Hint

Encourage loyalty by rewarding customers with vouchers or discount codes for trading in their pre-loved items.

Get started on a recommerce program

The more that brands can talk about and offer more sustainable ways of purchasing, the more we invite opportunities for this way of thinking.

Committed to sustainability? It’s all about transparency

of Gen Zs prioritise sustainability and ethical practices when making purchasing decisions2 – but it’s important brands tread lightly when it comes to sustainability marketing.

Sustainability has emerged as more than just a buzzword in the retail space. From eco-friendly packaging to carbon-neutral shipping, businesses of all sizes are increasingly recognising the importance of demonstrating their commitment to sustainability (thanks largely to the eco-conscious Gen Z shoppers).

Honesty is the best policy

For Australian fashion brand, ALÉMAIS, transparency is key in an industry that is notoriously opaque around sustainable practices. Kelly Elkin, Head of Environmental and Social Impact at ALÉMAIS explains how it’s a constant work in progress to ensure each touchpoint is considered in the manufacturing process.

“We have 100% transparency of our Tier 1 suppliers through a third-party social audit, where we review and rate them based on key areas like wages, safety and environmental impact,” says Kelly. “We’re on that journey and doing our best to move towards more social enterprises that are less about profit, more about people.”

Being specific about sustainability claims also builds trust with consumers who want to make informed and responsible choices. Like ALÉMAIS, consider including the origins of your product on the packaging or showcase your suppliers on your website.

“You don’t need to be doing everything all at once… if you’re honest about your progress and can translate that to your customer, they will respect you,” says Kelly.

Handy Hint

Integrate QR codes on your packaging that lead customers to a webpage or video explaining your sustainability initiatives in more detail.

Get tips on building your sustainability story

We are the first ones to say we’re not perfect, but we are working on being able to understand where our fabrics come from.

Don’t let perfect stop you from progressing

AI made simple: Scaling up with machine learning

From empowering retailers to make data-driven decisions to elevating the customer experience, AI can (and should) be leveraged by businesses of all sizes.

It’s no secret that AI is impacting the retail landscape in a big way and yet, only 1-in-3 businesses say they use AI to assist with business processes14. Understandably, the adoption of AI can be a daunting task, but Sarah Carney, National Technology Officer at Microsoft Australia and New Zealand explains the benefits are endless for both retailers and consumers.

Security risks and considerations

As with the adoption of any new technology, AI can present some risks. Attackers are using this technology to refine their phishing messages and develop enhanced malware, with Australia the equal 5th most targeted nation in the APAC region across June 2022-2314.

While this sounds worrying, there are simple steps retailers can take to protect their business and customers. “To safeguard their systems, retailers should firstly train their staff on predicting attacks and how to mitigate them.

Regular compliance checks are also a must, ensuring staff understand the procedure should a breach occur,” says Sarah.

“Finally, retailers of all sizes should seek the support of cyber security vendors to monitor their IT environment for threats.”

Did you know:

More than 2 in 3 Australian workers would be comfortable using AI for:Administrative tasks

Analytical work

Creative aspects of their role

If we look at a specific area many small businesses spend considerable time on – social media and marketing – we can see the positive impact of generative AI immediately.

Future of eCommerce

Retail industry expert, Paul Zahra, shares what’s ahead for eCommerce – including the evolving trends that will redefine the way we shop and connect.

The last word from Paul Zahra

Our retail sector is dynamic and ever evolving. The COVID-19 pandemic accelerated trends that were already occurring in the industry, and one of those was the growth in online shopping.

Methodology

From interviews to statistics, we aim to provide retailers with the relevant shopping insights so they can find their ideal retail strategy.

Read full Methodology